Apr 19, 2024

ECB Needs to Remain Restrictive Even If Cuts Start, Nagel Says

, Bloomberg News

(Bloomberg) -- Interest-rate cuts are nearing in the euro zone, but borrowing costs must for now remain high enough to damp demand and finish bringing consumer-price growth back to target, European Central Bank Governing Council member Joachim Nagel said.

“We will have to remain restrictive for some time to tame inflation sustainably — even if we can probably reduce the degree of restriction a little bit soon,” the Bundesbank president said in an interview in Washington.

Speaking on the sidelines of the International Monetary Fund and World Bank spring meetings, Nagel said that recent sticky consumer prices in the US “teaches us that we should approach the subject of inflation with humility.”

Nagel is among a group of officials who are cautious about loosening monetary policy due to the economic situation in the US and geopolitical risks. His comments contrast with more dovish officials like Greece’s Yannis Stournaras, who want quick rate cuts to reduce the burden on the struggling euro-area economy.

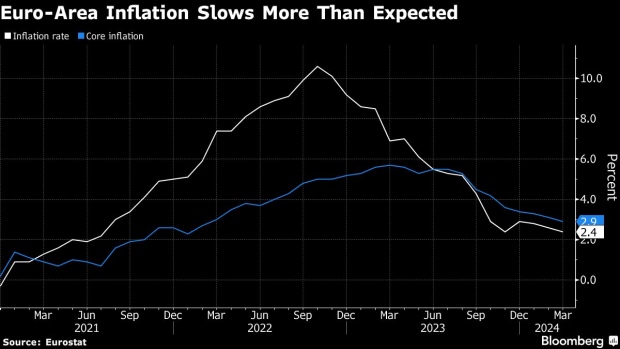

With price growth moderating more than anticipated in March, to 2.4%, policymakers have signaled that a first move down after the unprecedented tightening campaign in 2022 and 2023 is likely in June. But they’re not pre-committing or giving any guidance on the path beyond.

Nagel said the inflation picture in Europe is “currently broadly in line” with the latest ECB projections, which foresee price growth falling to the 2% goal in the second half of 2025. “If this continues to be confirmed by incoming data, a first interest-rate cut in June is becoming more likely,” he said. “But we have to wait for the data and then decide on that basis.”

Any discussion about what happens afterward “is absolutely premature,” Nagel said. “The situation is currently extremely volatile and there is great uncertainty,” he said, citing tensions in the Middle East. “If, for example, oil prices were to rise significantly, we would have to think very carefully about how to deal with it, whether we could really just ‘look through’ it.”

Nagel doesn’t share concerns about inflation falling too far below 2%. “At the moment I don’t see any great risk of inflation undershooting down the road.” On the contrary, “we can’t rule out the possibility of inflation becoming entrenched at too high a level,” he said.

While sticky US prices are making the Fed more reluctant to lower borrowing costs, Nagel said the ECB’s monetary policy “is geared toward the euro area and we have to do what is necessary for the euro area.”

“But of course, developments in the US also influence the situation in the euro area, for example via the exchange rate or the global interest-rate level,” he said. “We are keeping an eye on that.”

©2024 Bloomberg L.P.