Apr 26, 2024

Russia Holds Rates With Little Inflation Relief in Sight

, Bloomberg News

(Bloomberg) -- Russia kept interest rates unchanged on Friday, shifting toward more cautious guidance as inflation risks from a persistently tight labor market and growing consumer spending limit the central bank’s options.

For the third meeting in a row, policymakers left their key rate at 16%, in line with the unanimous forecasts of economists surveyed by Bloomberg. In a statement accompanying the decision, the central bank said “tight monetary conditions will be maintained in the economy for a longer period than previously forecast.”

Policymakers also updated their main forecasts and now project a higher path for rates and faster inflation this year. Gross domestic product is now expected to grow 2.5%-3.5%, nearly double as much as previously estimated.

Speaking after the decision in Moscow, Governor Elvira Nabiullina said that if disinflation stalls, the central bank doesn’t rule out a hike or leaving borrowing costs unchanged through the rest of the year. But the base case is for a rate cut in the second half, she told reporters.

“Exactly when that will happen depends on the pace at which current price growth slows down,” she said.

The decision followed a day after complaints over elevated rates made at President Vladimir Putin’s meeting with Russia’s biggest business lobby group. While Putin praised the central bank’s “very careful” efforts to deal with what it considers the “threat of inflation,” he noted “positive and downward trends” in price growth.

Nabiullina has previously warned that she might be forced to keep monetary conditions tight for a prolonged period in order to bring inflation back to its 4% target, which it currently exceeds by almost double.

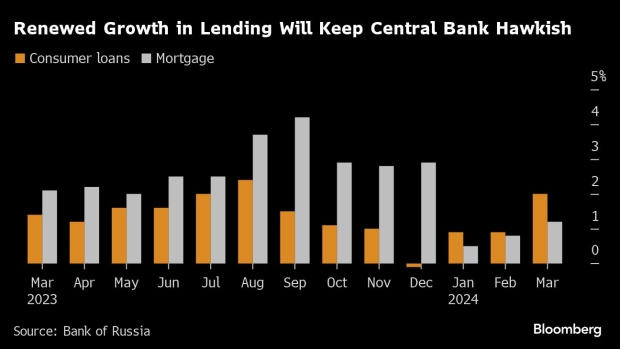

The Bank of Russia’s own criteria for starting to cut the cost of borrowing have remained mostly unmet, with worker shortages worsening while consumer activity and lending starts to pick up again. Meanwhile, the rate adjusted for inflation expectations has reached levels similar to those in the first months of the invasion of Ukraine in 2022.

Inflation expectations have retreated sharply from their December peak, and price growth showed signs of slowing in March. But in April, inflation accelerated again, driven by a rise in the cost of food and motor fuel, according to estimates from Renaissance Capital’s Andrei Melaschenko.

The April price growth data undermine the first condition that policymakers laid out following their previous meeting for considering a future rate cut: a sustainable decrease in inflationary pressure. The central bank said it also wants to see consumer lending and consumer activity cool and the country’s labor shortage ease, none of which has happened so far.

The war on Ukraine has intensified an acute labor shortage as military recruitment draws workers out of the market. That has sparked a wage spiral as employers compete for staff.

Russia’s gross domestic product will expand by 2.8% this year, compared with an earlier forecast of 2.3%, Economy Minister Maxim Reshetnikov told a government meeting Tuesday. Reshetnikov said the ministry revised its inflation outlook for the year upwards to 5.1% from 4.5%.

What Bloomberg Economics Says...

“The Bank of Russia is unlikely to consider the first cut until June or July, as the labor market remains tight. This caution is warranted because risks to inflation remain skewed to the upside. We expect year-over-year price gains to peak at 8.1% in May and decline to about 5.5% by December.”

—Alexander Isakov, Russia economist. For more, click here

At the same time, the latest banking sector data show that growth in consumer lending in the country doubled from February. Lending volumes are rising more than twice as fast as the Bank of Russia’s forecast of 0.4%-0.8% in average monthly terms for the year, Rosbank estimates show.

The central bank’s revised economic outlook is an “acknowledgment of the high potential of domestic demand and the persistence of pro-inflationary risks,” said Rosbank economist Evgeny Koshelev. By lifting the trajectory for borrowing costs, officials could be trying to “get economic agents accustomed to expecting higher interest rates” over the medium term, he said.

©2024 Bloomberg L.P.