Nov 9, 2017

‘Because of me’: How Trump's first year helped fuel record stock rally

U.S. President Donald Trump has repeatedly taken credit for the sustained rally in U.S. equity markets, expanding his boasts on Twitter by proclaiming to reporters on Air Force One over the weekend that it was his influence driving U.S. indices to new record highs.

"The reason our stock market is so successful is because of me,” Trump said. “I've always been great with money, I've always been great with jobs, that's what I do."

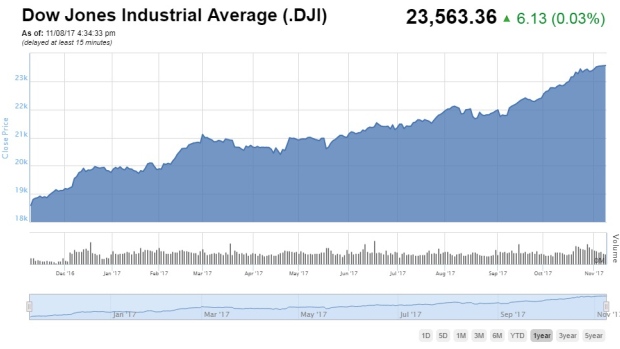

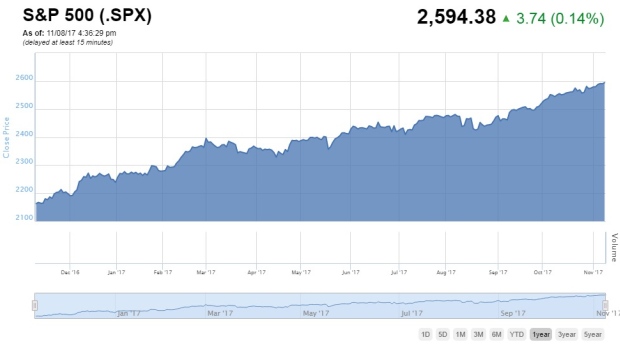

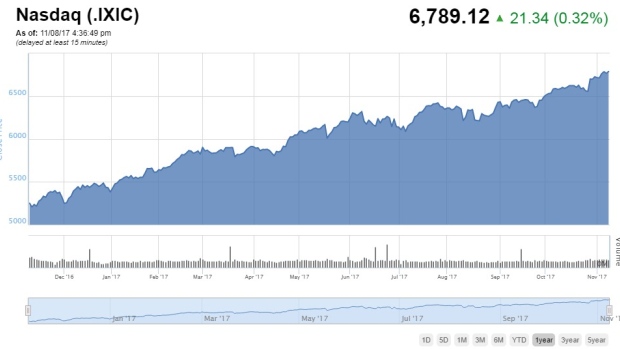

While all the double-digit returns on the Dow and the S&P 500 are nothing to sneeze at, their rankings among the primary global market returns cast some doubt over the Trump effect. The Dow Industrial’s 28 per cent return since Nov. 8, 2016 has it ranked 22nd in the world, sandwiched between the Athens Exchange and the Chilean market. Even further down the list is the S&P 500, sitting in 43rd spot between Mauritius and Singapore’s Straits Times Index.

Regardless of whether Trump can actually take credit for the rally or if it was merely a systemic flight into equities in the face of persistently low interest rates, the U.S. President’s influence looms large over the top five performers on the Dow since the election. Not a single one of the five top performers on the Dow has been untouched by Trump’s economic pledges, either enacted or proposed.

HAVE YOUR SAY

What deserves the most credit for driving U.S. stocks over the last year?

Boeing: +86.8 per cent

Caterpillar: +62.1 per cent

Apple: +58.7 per cent

McDonald’s: +49.1 per cent

UnitedHealth: +47.5 per cent

Boeing (BA.N):

The biggest percentage mover has been perhaps the company most visibly boosted by Trump’s protectionist stance. Washington helped widen Boeing’s moat in the U.S. market when it slapped nearly 300 per cent tariffs on Canadian airplanes, essentially taking aim at Bombardier’s CSeries narrowbody jet. While Boeing was active in lobbying for the punitive tariffs, it’s was posting strong performances even before the trade action, prompting it to boost its full-year profit estimates in its second-quarter earnings report.

Caterpillar (CAT.N):

Long a dog of the Dow after the commodities rout hammered heavy-equipment demand, Caterpillar has turned in a blowout performance over the course of the last year. A combination of the recovery in the oil and gas extraction sector and a rebound in housing activity helped power the company to a big third quarter profit beat, but some of Trump’s proposals could pose a risk down the line, given the company’s exposure to the Chinese market.

Apple (AAPL.O):

Perhaps no company would get a bigger benefit from the U.S. allowing a one-time repatriation of cash at a lower tax rate than Apple. The world’s largest company’s cash pile is largely stashed overseas, standing at US$252.3 billion at the end of the fourth quarter, 94 per cent of Apple’s total. In spite of the possible economic benefits for his company, Apple CEO Tim Cook has criticized the President for his handling of the racial violence in Charlottesville and his stance on immigration and environmental issues.

McDonald’s (MCD.N):

A confident consumer has helped McDonald’s drive traffic over the course of Trump’s presidency, with same-store sales growth in the United States gaining traction. Customers have been happy to spend a little more at the restaurant after it introduced premium, higher priced sandwiches in a bid to regain ground lost to so-called fast-casual restaurants like Shake Shack and Chipotle.

UnitedHealth (UNH.N):

Somewhat conversely, given Trump’s criticism of both the Affordable Care Act and drug pricing, healthcare benefit provider UnitedHealth rounds out the top five. On the company’s most recent conference call, newly-minted Chief Executive Officer Dave Wichmann said he actually expects UnitedHealth to find new opportunities under the plan, which would allow people to band together to buy cheaper, less-regulated health plans for providers like his firm.