May 22, 2019

Apple earnings could be cut 29% on China ban, says Goldman

, Bloomberg News

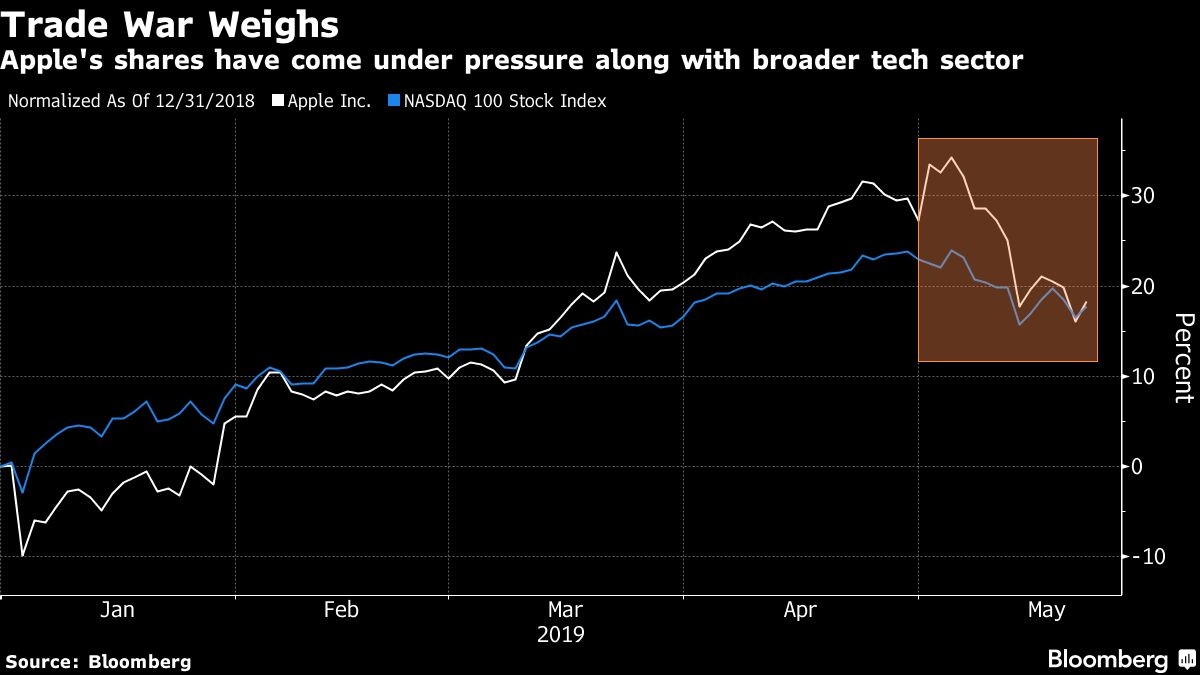

As Trump takes aim at Huawei, Apple may be targeted by China next

Goldman Sachs analysts have crunched the numbers and found that if China was to retaliate against the U.S. with a ban on sales of Apple Inc.’s (AAPL.O) products, this could wipe out 29 per cent of the iPhone maker’s earnings.

Though Goldman takes no view on the likelihood of a potential ban, such a restriction would represent 100 per cent of estimated Apple earnings exposure to both mainland China and Hong Kong, assuming some offsetting impact from cost savings in sales and marketing, analysts including Rod Hall wrote in a note.

Worries over the wider impact of the trade war have intensified after the U.S. blacklisted Huawei Technologies Co. last week, which places a question mark over the Chinese company’s partnerships with U.S. chipmakers, software and component suppliers.

Goldman also said they believe Intel Corp.’s latest XMM modems for the iPhone are made in the U.S., while Apple’s A-series chips are made in Taiwan and memory and display components also originate from outside China. Most of the rest of the iPhone supply chain is in mainland China, and if China were to restrict iPhone production in any way, Goldman does not expect Apple would be able to move much volume outside the country on short notice.

Goldman, which has a neutral rating on Apple’s stock, lowered the company’s price target to $178 from $184, maintaining the broker’s position among the more bearish Street analysts. The stock closed at US$186.60 on Tuesday.