Jan 5, 2017

As the TSX nears its record high, here's how the index staged its comeback

The TSX Composite is within striking distance of its all-time high, set more than two years ago when the benchmark composite closed at 15,657.63 on September 3, 2014. The composite has taken a rocky road to recovery, as commodity prices plummeted to lows unseen over the course of the last decade before reversing course on the back of Chinese demand and an OPEC agreement to curtail oil production. Below, a roadmap of how the TSX staged its comeback, and a selection of sectors that did their best to stand in the way.

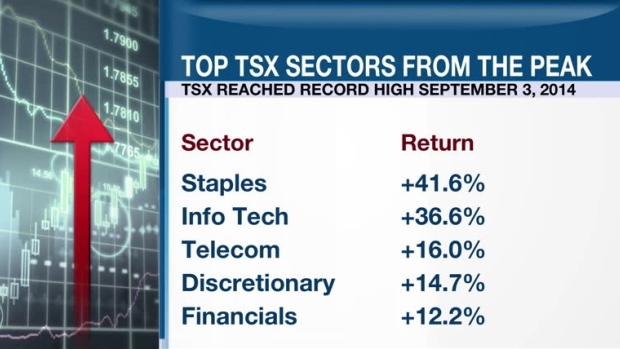

Consumer staples held the fort for the TSX over the course of the last two and a half years, as yield-hungry investors piled into those stocks due to record-low interest rates and general risk aversion stemming from global stability concerns. Alimentation Couche-Tard (ATDb.TO) is the heavyweight in the group, and could see its US$3.8-billion acquisition of CST Brands help propel it to be the largest revenue-generator on the composite.

Ottawa cloud-computing firm Kinaxis (KXS.TO) posted the largest gain since the last peak, helping push the info tech sector to the second-best performance. The company has ridden a surge in demand for cloud-computing services to a more than 250 per cent gain as it signs on more firms to its supply-chain software. Bus-maker New Flyer Industries (NFI.TO) also had two years of explosive growth, as its $604-million purchase of MCI expanded its reach in the long-haul coach segment.

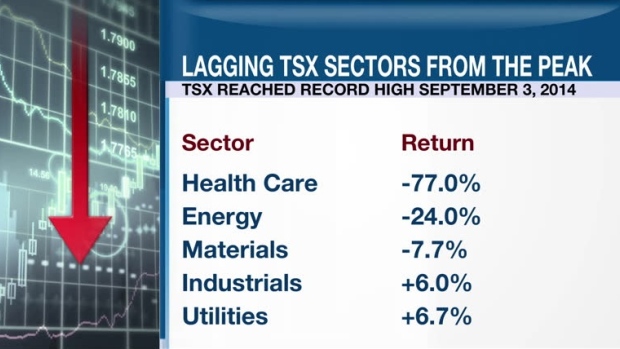

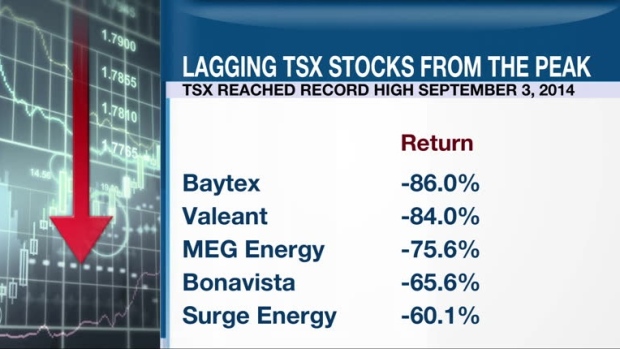

The health care subgroup shed more than three quarters of its value over the course of the last two and a half years, with two main culprits for the decline: Valeant Pharmaceuticals (VRX.TO) and Concordia International (CXR.TO). Valeant’s accounting scandal surrounding specialty pharmacy Philidor cost CEO Michael Pearson his job, and the high debt-load accrued under his watch has current CEO Joseph Papa looking at asset divestitures, including the company’s Salix unit.

The embattled pharmaceutical firm managed to avoid the worst performance of any stock since the peak, with Baytex Energy (BTE.TO) seizing the spot. The heavy-oil producer suffered under crashing crude prices and its crushing debt load, sending the stock from the mid-$40 range to the current $6 per share.