Jan 19, 2018

Bay Street warns 'perfect storm' for markets won't last in Trump's second year

The U.S. equity markets have been on an absolute tear since U.S. President Donald Trump’s inauguration a year ago. The Dow Industrials have smashed through a series of psychological milestones on their march into uncharted territory, including taking just eight days to soar from 25,000 points to 26,000 earlier this month.

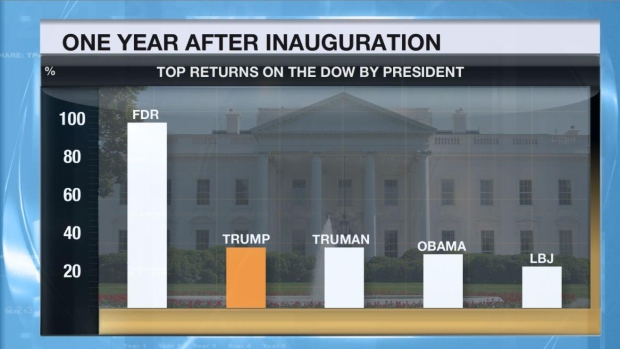

On a percentage basis, the rally exceeds that seen in the first year of any postwar president, and on an overall basis only lags the historic 96-per-cent returns investors saw under Franklin D. Roosevelt in 1933.

And the magnitude of the surge hasn’t been lost on the president. Trump has oft-crowed about the performance of the Dow during his presidency, tweeting about the stock market 57 times since taking the oath of office and has repeatedly taken credit for the record-breaking run.

But investors are being warned a rally of this magnitude isn’t built to last. Craig Basinger, the chief investment officer at Richardson GMP, doesn’t see the stars aligning this year as they did in 2017.

“The general rule of reversion to the mean would dictate that no, we won’t see 2018 play out with the same kind of rally we saw last year,” Basinger told BNN in a telephone interview. “Last year was really a perfect storm. You had broad-based global economic growth, growth in the United States and a falling U.S. dollar, which was stimulative.”

Among the biggest benefactors of that stimulative environment were Boeing, with a 113-per cent-return over the last year; and Caterpillar, which rose nearly 80 per cent. Both companies typically perform well when investors believe the economic cycle is accelerating, and would be further boosted by lower taxes and less regulation.

Basinger said in spite of the strong start to 2018, he thinks a rising rate environment will ultimately temper equity market returns over the course of the year.

“Our concern is this: Things are still quite positive, but we’re starting to see some minor worrying signs on the inflation front,” he said. “It will depend on the data, but at some point these higher bond yields are going to weigh on multiples.”

Basinger isn’t alone in his concern that multiples will be compressed by a tightening U.S. Federal Reserve. Philip Petursson, chief investment strategist at Manulife Investments, said he expects much more moderate returns on the U.S. equity markets this year, in part due to a contraction in price-to-earnings multiples.

“The combination of strong earnings growth and a [price to earnings] contraction will lead to a mid-to upper-mid single digit return,” Petursson told BNN in an email. “The extent by which the market surpasses this target will be dependent on whether we actually see a PE contraction or not. The S&P 500 index has enjoyed a PE expansion (on a trailing basis) in each of the last six calendar years. This is somewhat unprecedented.”

Though Petursson is forecasting a return to norm for this year’s stock market performance, he cautioned investors may have to travel a rocky road to get there.

“While we believe the market could experience a correction of 10-15 per cent at any time this year, we are confident that there is a high probability for positive returns through 2018 as we do not see immediate risk of recession, which is a precursor to negative markets,” he said.

Though Trump has been stymied on a number of legislative fronts, including his failure to repeal and replace the Affordable Care Act, his recent win on the tax front has Sun Life Global Investments Chief Investment Officer Sadiq Adatia convinced the rally has legs in the near term.

“Generally we feel the first half of the year will be pretty good but we will start seeing some weakness in the second half of the year. Overall, U.S. tax cuts will help keep confidence high and consumers spending,” Adatia told BNN in an email. “Even though we expect interest rates to rise multiple times, the rates remain relatively low and still allow growth to continue.”

“Wealth is also near all-time levels so that allows for some cushion in case there are some bumps along the way,” he added. “The one major caveat is if tensions build up with North Korea -- that would result in risk aversion across the board.”

In spite of Trump’s repeated boasts that his administration is the root cause of the rally, Richardson GMP’s Basinger said underlying strength in the American economy, earnings growth and accommodative monetary policy deserve the credit.

“In the media, it’s 90 per cent Trump, and 10 per cent the other stuff. In reality, it’s pretty much the opposite,” he said. “They’ve passed tax reform, but the other [initiatives] just haven’t progressed.