Jun 8, 2017

BNN's Daily Chase: Investors brace for 'Super Thursday'

By Noah Zivitz

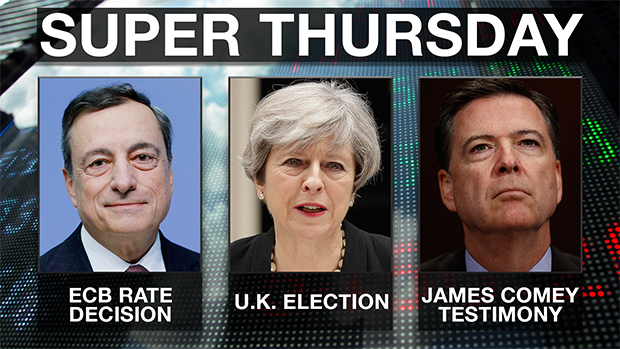

SUPER THURSDAY

At last, Super Thursday. There are three major events that all have the potential to move markets:

ECB rate decision: As expected, the European Central Bank kept rates on hold. But there was one change to the statement that caught investors' attention. Gone is the reference to rates potentially dropping to "lower levels". The real intrigue, as always, is around President Mario Draghi’s choice of words. Here’s Kit Juckes’ take over at Societe Generale: “We're told that the ECB is going to revise its inflation projections lower (to 1.5 per cent from 1.7 per cent for 2019) and declare that the overall risk assessment is broadly balanced for the first time since Mario Draghi took office.” (my emphasis there, not Kit’s). Again, as expected, he just said risks to the growth outlook are “broadly balanced”, while adding inflation remains “subdued.”

James Comey testimony: The former FBI director’s prepared remarks are out, revealing not only the details of his meetings with Donald Trump, but also the degree to which he found it prudent to document those sessions. Investors pushed the S&P 500 higher yesterday afternoon amid the lack of bombshell revelations. The great unknown is whether lawmakers’ questions this morning will elicit an answer that rattles markets – or the White House. Remains to be seen if Trump will live tweet the hearing.

U.K. election: Either late tonight or early tomorrow, British Prime Minister Theresa May will find out whether her gambit in calling a snap election was worth it. Polls close at 5:00 p.m. ET. At stake is 10 Downing Street’s leverage in Brexit negotiations with the European Union. We’ll set the scene throughout the day with CTV’s Daniele Hamamdjian in London.

BANK OF CANADA FINANCIAL SYSTEM REVIEW

The central bank releases its deep dive on vulnerabilities across Canada’s financial system later this morning. Mortgage debt is sure to factor prominently. The elephant in the room is Home Capital Group, which BoC Governor Stephen Poloz has already described as being “idiosyncratic.” Still, shouldn’t come as a surprise if Poloz faces a question on that file during the news conference at 11:15 a.m. ET.

BNN Advisor

Vancouver: Housing concerns cross generations

Winnipeg and Saskatchewan: The loonie and U.S. protectionism weigh on Central Canada

Yellowknife and Whitehorse: The hurdles of northern living and aboriginal issues

M&A THURSDAY

We just got a pair of deals at the top of the 7:00 a.m. ET hour. Valeant Pharmaceuticals said it's selling iNova Pharmaceuticals to Pacific Equity Partners and The Carlyle Group for $930 million. Proceeds going toward repaying debt. CEO Joseph Papa hinting there’s more to come: “We will continue to evaluate opportunities that will enable us to deliver on our commitments and unlock value for shareholders,” he said in a statement.

And ECN Capital said it's paying $410 million to acquire Service Finance Holdings, which "originates and services prime and super-prime installment contracts to finance home improvement projects in the U.S."

OTHER NOTABLE STORIES

-Oil is fighting to stabilize after tumbling 5 per cent yesterday. At last check, crude was trading marginally above US$46 per barrel.

-TransUnion's new report on Canadians' borrowing trends shows the average non-mortgage debt load in Canada rose 1.9 per cent year-over-year to $21,696 in the first quarter. Regional divergence is always interesting. The most aggressive borrowing was in Vancouver (+4.27 per cent y/y), while Calgarians fell furthest behind (delinquency rate rose 6.6 per cent y/y).

-The Globe and Mail is pointing out this morning that boutique investment dealer Eight Capital has swapped out its CEO on the back of a recently-terminated arrangement to co-lead an $80-million financing for Cannabis Wheaton.

-Home Capital Group’s high interest savings account balance slipped to $106.3 million as of Tuesday from $107.1 million on Monday.

-DavidsTea shares are falling in pre-market trading after the retailer swung to a first-quarter loss as same-store sales fell almost 6 per cent. Also announced CFO Luis Borgen is leaving at the end of July and warned of ongoing margin pressure

-CIBC received all regulatory approvals for the PrivateBancorp deal

NOTABLE RELEASES/EVENTS

-Notable earnings: HBC, Transat, Transcontinental

-Notable data: Canadian new housing price index, China inflation

-7:45 a.m. ET: ECB releases rate decision

-8:30 a.m. ET: ECB President Mario Draghi holds news conference – Live via webcast

-9:00 a.m. ET: Natural Resources Minister Jim Carr holds media call from China

-9:00 a.m. ET: Enbridge holds investor meeting in Toronto

-10:00 a.m. ET: Former FBI Director James Comey to testify before U.S. Senate Intelligence Committee

-10:30 a.m. ET:: Bank of Canada releases Financial System Review.

-11:15 a.m. ET: Bank of Canada Governor Stephen Poloz and Senior Deputy Governor Carolyn Wilkins hold news conference

-11:30 a.m. ET: Prime Minister Justin Trudeau holds media avail in La Malbaie, Quebec

-12:00 p.m. ET: BMO CEO Bill Downe delivers speech in Toronto

-12:00 p.m. ET: Yahoo holds special shareholders meeting for vote on proposed sale of core business to Verizon

-5:00 p.m. ET: United Kingdom general election

Every morning BNN's Managing Editor Noah Zivitz writes a ‘chase note’ to BNN's editorial staff listing the stories and events that will be in the spotlight that day. Have it delivered to your inbox before the trading day begins by heading to www.bnn.ca/subscribe.