Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

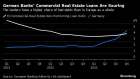

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Apr 11, 2017

The Canadian Press

TORONTO - Moody's Investors Service has released a report that identifies Canada as one of four Aaa-rated countries that are exposed to a potential housing market correction.

In addition to Canada, the report lists New Zealand, Sweden and Australia as countries that have seen the largest increases in home prices and household debt among advanced economies over the last three years.

Moody's says a housing downturn could involve material spillovers to the broader economy for Canada and New Zealand, where residential construction accounts for approximately 7.5 per cent of GDP in both countries.

However, Moody's says that unless reversals in house prices are accompanied by other long-lasting negative shocks, they would not fundamentally undermine the sovereigns' credit profiles.

The debt rating agency says all four countries have strong banking systems with high capitalization levels, conservative business models and strong liquidity.

The housing sector has been identified as a risk for the Canadian economy as housing prices have marched higher, fuelled by low interest rates.