Nov 2, 2017

Canadian Natural Resources commits to shipping more crude via Keystone XL

, Reuters

Canadian Natural Resources Ltd (CNQ.TO) has increased its volume commitment on TransCanada Corp's (TRP.TO) Keystone XL pipeline by about 46 per cent to 175,000 barrels per day (bpd), Canadian Natural President Steve Laut told Reuters on Thursday.

The bigger commitment from one of Canada's largest oil and gas producers will be a boon to TransCanada, at a time when Canadian pipeline companies are trying to push through new projects in the face of fierce environmental opposition and concerns about slowing oil sands growth.

TransCanada's open season to gauge interest from producers wanting to ship on the 830,000 bpd pipeline ended last week.

The company has not released the results or said what volumes it would need to push ahead with the project. Canada's two other biggest energy producers Suncor Energy (SU.TO) and Cenovus Energy (CVE.TO) have said they are committed shippers on Keystone XL, without disclosing contracted volumes.

Canadian Natural is growing its oil sands operations after completing an expansion at its Horizon project in northern Alberta, which will add 80,000 bpd of production.

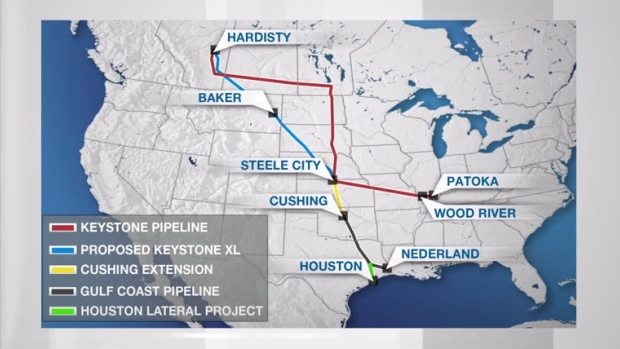

Keystone XL would transport crude from Alberta to the U.S. Midwest but has been delayed for eight years by regulatory hurdles. U.S. President Donald Trump this year granted a presidential permit for the pipeline, reversing a rejection by the Obama administration.

Oil prices have been in a deep slump since 2014, prompting Canadian producers to scale back plans for growth and fuelling speculation that TransCanada could struggle to get enough shippers to support Keystone XL.

TransCanada Chief Executive Officer Russ Girling said in May that lower oil prices and alternative export routes were complicating shipper negotiations.

Bloomberg, citing sources, reported on Thursday that TransCanada had asked the Alberta government to buy capacity on the pipeline.

TransCanada spokesman Terry Cunha declined to comment on the Bloomberg report, adding that it "will spend the fourth quarter reviewing the commercial support of the project."

Alberta government spokesman Mike McKinnon did not comment on the Bloomberg report but said the government supported all pipeline projects and had not ruled out any options.

"We make decisions on a project-by-project basis, weighing all economic considerations," McKinnon added.

Last month TransCanada scrapped its proposed 1.1 million bpd Energy East pipeline from Alberta to Canada's east coast amid mounting regulatory hurdles.

The Alberta government receives royalties in the form of barrels of bitumen from some producers and had been signed up to ship 100,000 bpd on Energy East.