Mar 30, 2017

CIBC boosts PrivateBancorp bid to US$4.9B in attempt to salvage U.S. takeover

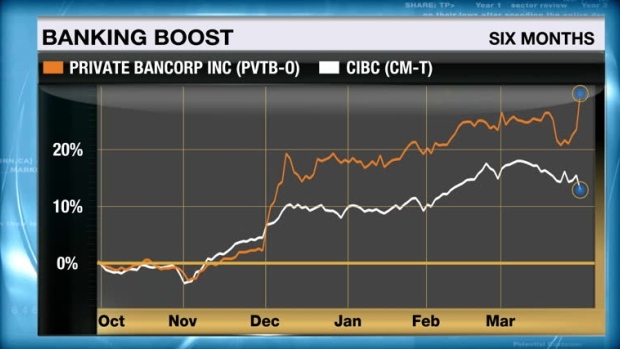

CIBC (CM.TO) boosted its takeover offer for Chicago-based PrivateBancorp on Thursday in a bid to salvage a deal that was thrown into doubt by the run-up in bank stock share prices since the U.S. election.

CIBC has agreed to pay US$24.40 in cash and 0.4176 of a share for each Bancorp share. Under the original terms of the deal established in June, CIBC was set to pay US$18.80 in cash and 0.3657 of a share.

The revised takeover agreement is valued at US$4.9 billion.

"We are pleased to have reached an amended agreement with PrivateBancorp," said CIBC CEO Victor Dodig in a statement. "The quality of its management team and its focus on building a client-first culture make PrivateBancorp an excellent fit with CIBC."

The sweetened bid means that the acquisition will not be accretive for CIBC’s bottom line until 2020, a fact that will not make CIBC shareholders happy, according to J. Zechner Associates Chairman John Zechner

“It’s going to take a little bit more time to pay for it and I think shareholders are going to be disappointed in the short term. Whether it works out in the longer term we have yet to see,” he told BNN in an interview.

Zechner says the CIBC bid will likely be sufficient to close the deal and doubts a competing bidder will emerge for PrivateBancorp. “I don’t see a third player coming in,” he said. “I don’t see [CIBC] having to put more money on the table.”

CIBC is aggressively pursuing the deal as a way to diversify its revenue base. While other banks such as RBC, TD and BMO have increased their exposure to the U.S. and other international markets, CIBC has remained relatively Canadian-centric.

“What’s important to them is getting the international diversification,” Zechner added. “They really needed to do this deal.”

The new offer substantially increases the chances the deal will get done, noted BNN Commentator Andrew McCreath. “It’s enough of a lift to get them talking again and there is a possibility of a deal getting done now whereas clearly the old terms were unacceptable and a deal was not going to get done,” he said.