Nov 9, 2017

Corporate investment could be delayed, biased toward U.S. amid NAFTA uncertainty: Magna CEO

, Reuters

Canadian auto parts maker Magna International Inc's (MG.TO) chief executive said on Thursday that uncertainty over NAFTA and proposed U.S. corporate tax cuts could prompt companies to suspend investment or pour capital into the United States.

U.S. President Donald Trump has threatened to withdraw from the North American Free Trade Agreement among the United States, Canada and Mexico, which is heavily used by automakers that have production and supply chains spread across the three countries.

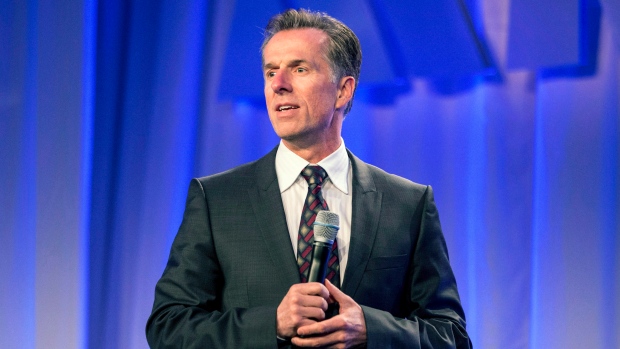

"I think anybody that is contemplating any big investments over the long term is probably either waiting or they are going to be biased to invest more in the U.S. until there's an outcome here," CEO Don Walker said on an analysts call, when asked about the impact of NAFTA talks on automakers.

But he said Magna had not changed the way it deploys capital because of NAFTA renegotiations or proposed U.S. corporate tax cuts.

Trump has proposed changes to the rules of origin for autos, which are used to determine how much of a vehicle is made in a certain place. The proposed rules were viewed as untenable for automakers, as well as Mexico and Canada.

On Thursday, Magna raised its full-year sales forecast for the third time this year on strength from outside North America, but warned that part of its transmission business could soften after 2017.

Magna Chief Financial Officer Vince Galifi told analysts that the company anticipates "some softening" in unconsolidated sales over the next couple of years from its Getrag business, which makes transmissions in locations such as Europe and China.

The softening "relates to a market shift from manual transmissions to automatic," in addition to certain customer growth plans now being forecast lower than previously expected, he said.

Magna shares fell 2.1 per cent in Thursday trade. On Wednesday, shares in rival auto parts maker Linamar Corp (LNR.TO) fell more than 13 per cent after reporting lower-than-expected earnings.

"Regardless of the lower than previously anticipated unconsolidated net sales, we still expect significant growth in Getrag's business over the next few years," Galifi said.

Ontario-headquartered Magna said it now expects 2017 total sales of US$38.3 billion to US$39.5 billion, compared with its previous forecast of US$37.7 billion to US$39.4 billion.

Total third-quarter sales grew seven per cent on an annual basis to US$9.50 billion, as stronger demand in Europe and Asia offset a five-per-cent decline in North America, where U.S. auto sales are expected to weaken in 2017.

Magna, which also assembles cars under contract from motor vehicle manufacturers, counts General Motors Co (GM.N), Volkswagen AG (VLKAY.PK), BMW (BMWYY.PK) and Ford Motor Co (F.N) as its biggest customers.

Magna also announced plans to buy back 35.8 million shares.