Apr 11, 2019

Doubts about the bull run still outweigh FOMO for U.S. stocks

, Bloomberg News

Light volumes, low volatility, little conviction. In U.S. stocks, fear of future falls outweighs any fear of missing out.

Trading activity across NYSE and Nasdaq exchanges is running at its slowest two-week pace since the S&P 500 Index hit its all-time high in September. It’s a similar story for the world’s largest exchange-traded fund, the SPDR S&P 500 ETF (SPY). Six of the 10 least-traded days this year have come in the past 10 sessions; volumes are running about half what they were during the same two-week stretch in 2018.

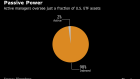

Low volumes point to stocks not being in a stressed condition: turnover tends to swell during times of turmoil. This dynamic also speaks to a persistent cap on investors’ desire to boost U.S. equity exposure -- continuing the first-quarter “flowless rally” -- that raises questions about how long a bull run without buyers can be sustained.

“The question is, will we get some kind of FOMO Rally?,” Jurrien Timmer, Fidelity Investments head of global macro, said in an interview on Bloomberg TV. “Or are people still kind of looking around the corner for where and when the next recession is going to be and thinking to themselves, ‘why should I buy now if we’re going to be in a recession in a year from now’?’’

Indeed, the FOMO rally that Goldman Sachs Group Inc. strategists forewarned of has yet to take hold: it’s a market that’s more skeptical and apathetic than complacent.

Nomura quant Masanari Takada chalks up the sideways action in U.S. stocks over the past week to “a buying exhaustion’’ on the part of systematic investors like CTAs and risk-parity funds. But he says it’s just a “cool down,” not “risk-off.”

Growth and value-oriented hedge funds, which posted high-single digit returns in the first quarter, also don’t appear to be engaging in anything resembling a beta chase. Net equity exposure in North America is in the 32nd percentile relative to the past year, according to JPMorgan Chase & Co. brokerage data.

“Low volumes are a symptom of light equity positioning, since return data is suggesting that hedge funds still are staying on the sidelines and not deploying money towards equities,” said Vinay Viswanathan, equity derivatives strategist at Macro Risk Advisors.

And where there is appetite for stocks, it’s in defensive-oriented names like the Utilities Select Sector SPDR fund, which has seen a combination of rising shares outstanding and falling short interest. Viswanathan’s colleague, Maxwell Grinacoff, cites a lack of “crowdedness” in long U.S. equity futures, citing commitment of traders positioning data.

The swelling spate of big-picture and company-specific catalysts -- U.S. banks kicking off earnings season after their executives were grilled by Congress, emerging clarity on a Brexit extension, a trade deal with China that could be inked just as megacap technology companies are releasing their results -- may be temporarily keeping investors on the sidelines until some of the fog clears. Or perhaps it’s just a matter of getting back to the office.

Indeed, the two biggest factors behind “depressed” volumes, reckons JonesTrading managing director Dave Lutz, are these “many macro unknowns and spring breaks!”