Jan 23, 2020

ECB kicks off broad-based review in search for elusive inflation

, Bloomberg News

ECB Holds Rates Steady, Announces Strategic Policy Review

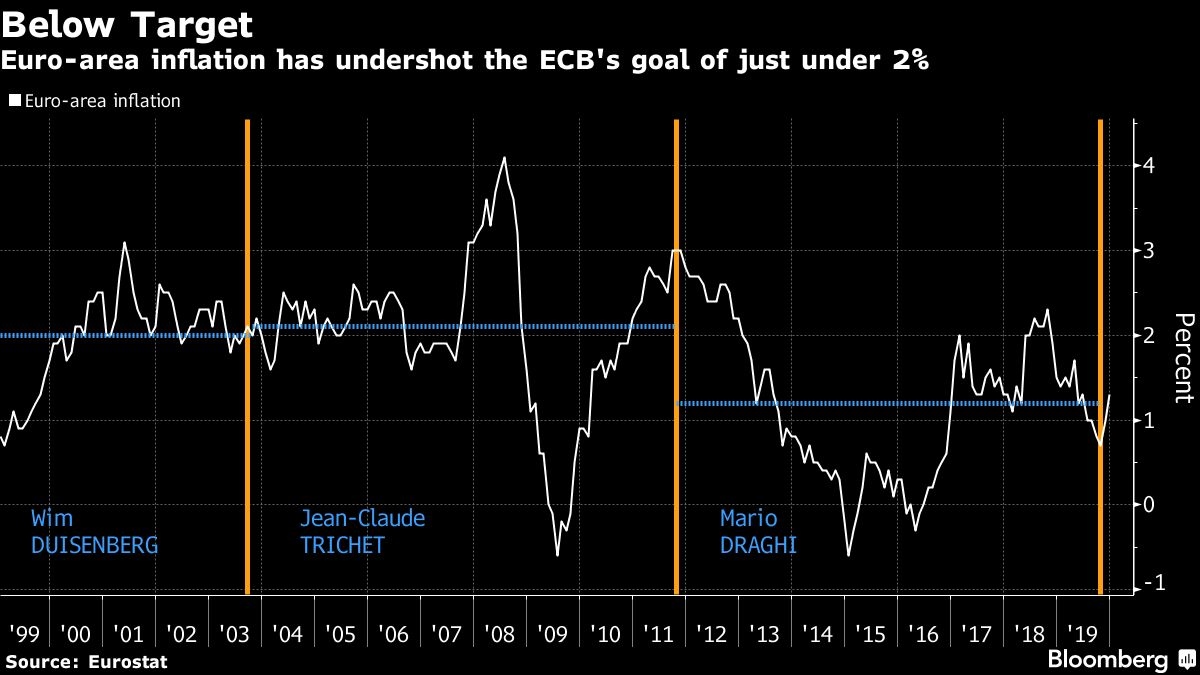

The European Central Bank agreed to review its strategy for the first time since 2003 in a rethink after years of radical monetary stimulus struggled to revive inflation.

The institution said it will provide details about the scope and timetable of the exercise in a press release today at 3:30 p.m. Frankfurt time, following President Christine Lagarde’s press conference.

Her efforts to modernize the ECB include potentially resetting the inflation goal of “below, but close to, two per cent,” studying alternative measures of price growth, and assessing its policy tools. She’s benefiting from signs that a deep manufacturing slump in the 19-nation economy is bottoming out before it causes greater harm to the labor market and consumer spending.

That should allow policy makers to focus on the review, which will last most of the year and also tackle issues including financial stability, climate change and communication.

The ECB is questioning its methods as globalization, digitalization and behavioral shifts challenge long-standing theories that inflation will pick up if you throw enough money at it. Negative interest rates and 2.6 trillion euros (US$2.9 trillion) of asset purchases so far resulted in consumer-price growth barely above one per cent.

Other economies haven’t fared much better. Japanese inflation has been muted for a generation despite extremely accommodative policy. In the U.S., where fiscal policy has helped a little, the Federal Reserve is also appraising its strategy. Those results are expected to be released this year and may be inspiration for the ECB, which has already said it will take a page out of the Fed’s book by listening to academics and members of civil society.

At the ECB’s meeting, the 500th since the central bank was founded two decades ago, the Governing Council also decided to keep the deposit rate unchanged at -0.5% and the pace of monthly bond buying at 20 billion euros ($22 billion), in line with economists’ expectations.

Policy makers reiterated their pledge that borrowing costs will remain at present or lower levels until the inflation outlook has “robustly” converged with their goal. Quantitative easing will “run for as long as necessary.”

Economic prospects have improved lately. Trade tensions have eased with the signing of a preliminary U.S.-China trade deal, though U.S. President Donald Trump warned this week that threat of car tariffs still looms over the European Union, and confidence among businesses and investors has picked up.

Gauges tracking future output by euro-area factories and orders from abroad suggest the trend may last. Volkswagen AG, the world’s biggest carmaker, saw global vehicle deliveries edg higher last year as it eked out a small gain in China and saw improved results in both Europe and South America.

The IMF’s latest update, released this week on the sidelines of the World Economic Forum in Davos, noted that global risks are “less skewed” negatively. So far, the ECB has described risks to the euro-area outlook as tilted to the downside. Investors will be watching Lagarde’s press conference to see if that changes.

--With assistance from Jana Randow, Piotr Skolimowski, Alaa Shahine, Craig Stirling, Fergal O'Brien, Jeannette Neumann, Zoe Schneeweiss, Brian Swint, David Goodman, Lucy Meakin and Jill Ward.