Sep 18, 2019

FedEx shakes Wall Street’s faith as 'execution failures' pile up

, Bloomberg News

FedEx tumbles after cutting profit outlook amid trade tensions

FedEx Corp. disappointed shareholders again by slashing its profit outlook, and Wall Street’s patience is running out.

At least four analysts downgraded the shares, sending shares tumbling by the most in four years. While FedEx said trade tensions were weakening the global economy and sapping demand for parcel deliveries, the company’s critics emphasized “elusive’’ business execution, an insufficient grip on costs and “acquisition debacles.’’

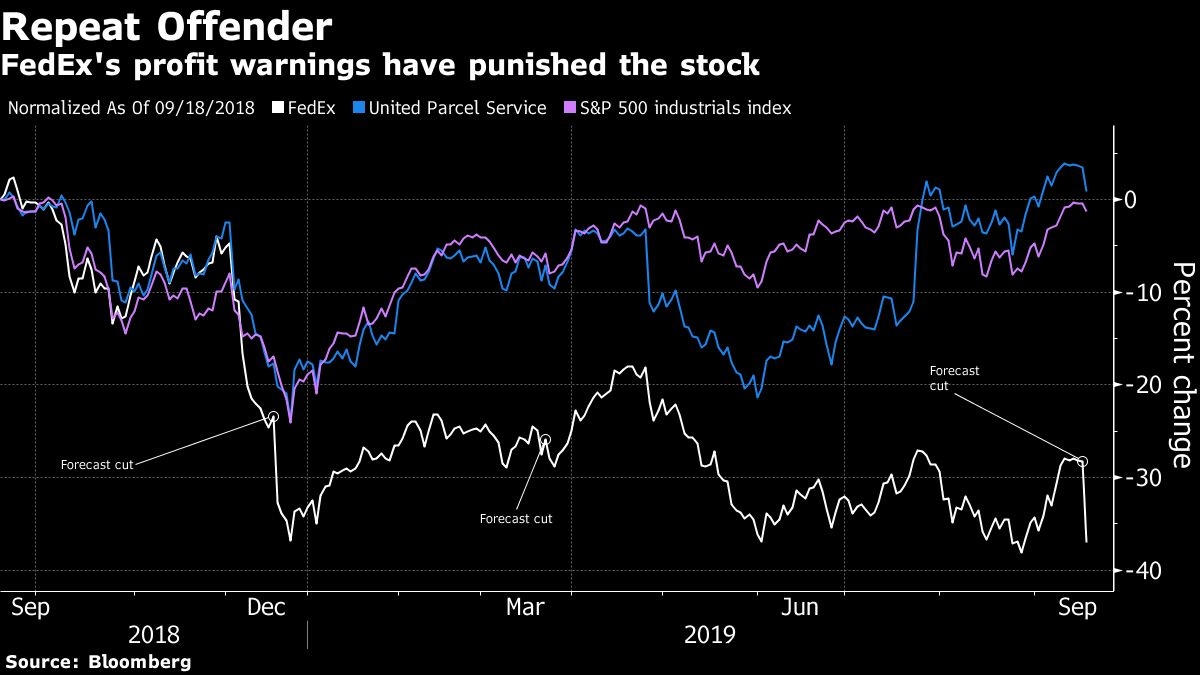

Investors’ mounting frustration underscored FedEx’s inability to keep up with even its own weakening expectations. The company has been making a habit of cutting its earnings forecast or missing analysts’ estimates while trailing the shareholder returns of rival United Parcel Service Inc. In addition to economic headwinds, FedEx is walking away from most business with Amazon.com. Inc. and still struggling to integrate a Dutch company it acquired in 2016.

“This is, I think, the fifth straight quarter of either missing numbers or cutting guidance,’’ Wolfe Research’s Scott Group told FedEx Chief Executive Officer Fred Smith and other company leaders on a conference call late Tuesday. “We need some hand-holding here.”

The shares plunged 14 per cent to US$148.55 at 11:12 a.m. Wednesday in New York after sliding to as low as US$148.50 for the biggest intraday decline since August 2015. UPS fell only 1.9 per cent while Deutsche Post AG slipped 1.5 per cent.

FedEx’s tumble wiped out its year-to-date gain. Even before the drop, the shares were already lagging UPS and a Standard & Poor index of U.S. industrial companies.

Deutsche Post responded to FedEx’s warning by saying that it hasn’t seen changes in volume trends since its most recent comments in August. UPS said it hasn’t detected a broad-based slump.

“UPS has seen softening in some markets as customers react to trade uncertainty, but has not experienced broad dampening,” the Atlanta-based courier said in a statement. “The company continues to manage costs and adapt its network to take advantage of growth opportunities as sourcing patterns shift among markets.”

‘Policy Uncertainty’

FedEx blamed the profit warning on global economic weakness “driven by increasing trade tensions and policy uncertainty.”

It’s not alone in feeling anxiety: The Business Roundtable’s CEO Economic Outlook Index fell in the third quarter to the lowest since late 2016, the group said Wednesday. More than half of CEOs said U.S. trade policy and retaliation from other countries had a negative effect on sales over the past year, while a third said it was having a similar impact on hiring.

Still, FedEx analysts said there’s a limit to the blame that the Memphis, Tennessee-based company can heap on the economy.

Citigroup Inc. analyst Christian Wetherbee called the outlook cut “drastic.” KeyBanc Capital Markets analyst Todd Fowler cut FedEx to hold from buy, saying the company’s execution of its strategy has been “elusive.”

Deutsche Bank AG’s Amit Mehrotra, who also downgraded the stock to hold, sounded a similar note and said the company had spent too much on planes for its Express air-shipping business.

“In reality, FedEx’s release is largely the result of many management missteps over the years, including overspending on aircraft despite weaker returns in Express over the long-term, and acquisition debacles,” Mehrotra said.

The weaker outlook underscored the hurdles for FedEx as the company introduces costly changes to its ground network to handle surging e-commerce deliveries while contending with rising competition from Amazon.com Inc. FedEx failed to renew contracts with Amazon for U.S. ground deliveries and air shipments as the e-commerce retailer builds out its own transportation network.

FedEx stuck with its plan to invest US$5.9 billion for fiscal year 2020, which ends in May, and will probably match that in 2021, Chief Financial Officer Alan Graf said on the call. The company needs to spend on more fuel-efficient aircraft and to modernize sorting hubs, Graf said.

But to reduce capacity at the Express air-shipping network, FedEx will retire as many as 20 older planes and park additional jets as it adjusts to the weaker economic outlook. The company already announced a US$575 million employee-buyout program in January.

Troubled Acquisition

An economic slowdown in Europe is hampering FedEx’s effort to turn around operations at TNT Express, a Dutch company acquired in 2016 for US$4.8 billion. Integration spending will be about US$350 million over the 12-months ending in May 2020, FedEx said in June, pushing the expected total to about US$1.7 billion by May 2021.

For now, the company is running both the TNT and FedEx networks in Europe, which drives up costs, said Kevin Sterling, an analyst at Seaport Global Holdings.

“This global macro weakness couldn’t hit them at a worse time. They’re kind of getting exposed. They’re kind of getting exposed,” Sterling said. “The international weakness hit them faster than they realized. It was just three months ago that they lowered guidance and now again they’re coming back to do it. The ultimate question is when is the bottom.”

--With assistance from Richard Weiss and Bailey Lipschultz