Mar 29, 2017

Four ways Brexit hits Canadians

Part of the problem with predicting how Canadian lives could change as a result of Britain leaving the European Union is there is no precedent to forecast how the next two years will evolve.

There are, however, certain effects Canadians will assuredly experience soon -- if they haven’t already.

Below, BNN takes a look at four of them.

Chocolate

Outrage ensued when Cadbury parent company Mondelez International increased the space between each triangle in a Toblerone bar in order to cut 150 grams along with some costs for the company as a result of Brexit uncertainty.

That isn’t stopping the chocolate maker from continuing the strategy known as “shrinkflation” with Cadbury U.K. boss saying earlier this week ongoing uncertainty surrounding regulations, trade barriers and tariffs meant a package of Creme Eggs would include just five treats down from six and the price of a Freddo chocolate bar would grow by one fifth.

Tourism

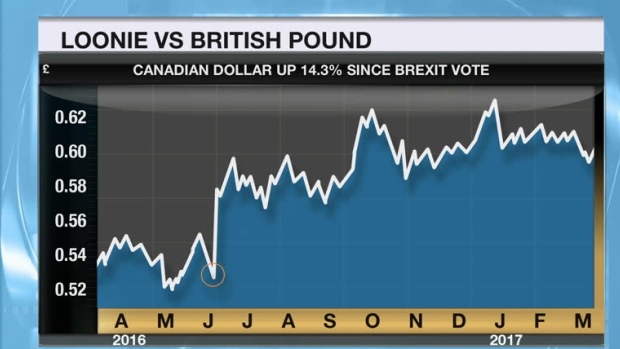

While Canadians may lament the loss of their favourite full-sized candy bars, they can take some comfort in knowing the cost of visiting the United Kingdom has been cut significantly as a result of Brexit. The British Pound has been under pressure ever since the June 24th vote to leave the European Union.

As of midday Wednesday the Canadian dollar was worth 14 per cent more against the Pound compared to its value before the decision. While that may be beneficial for Canadians looking to take a trip across the pond, it has not been so favourable for federal government coffers: The value of British Pounds held in Ottawa’s international currency reserves fell by nearly US$300 million in June 2016 as part of the fallout from the unexpected decision.

Trade

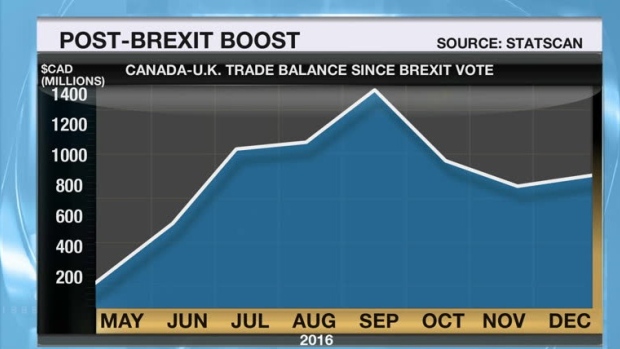

Despite the ocean that lies between us, Canada and the U.K. have an extremely close relationship with the island nation serving as the third-largest destination of Canadian exports. The value of those exports has also been growing considerably in recent years relative to imports from the U.K., pushing the balance of trade further and further in Canada’s favour.

That trend accelerated in the months following the Brexit vote though the uncertainty surrounding future trade relationships cloud the ability of experts to predict whether that trend will continue. Britain also serves as the single largest destination for Canadian direct investment in Europe; according to Export Development Canada the figure stood at nearly $93 billion in 2015.

Yet with the U.K.’s future as a conduit to Europe uncertain to say the least, whether that trend can continue is also unclear.

Portfolio

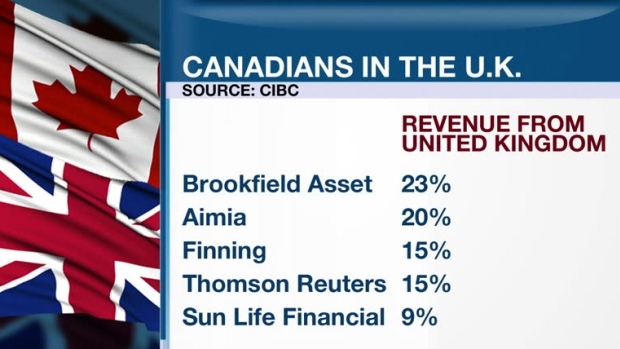

More than 630 Canadian companies have operations in the United Kingdom, according to EDC data. While not all of them are publicly traded, many of those that are could see their stock values face headwinds depending on how and when the myriad of relevant issues are each addressed throughout the Brexit process.

Some Canadian companies have more exposure to the British market than others and while many have natural hedges in place (i.e. the proportion of their revenue in British Pounds is similar to the proportion of their expenses in the same currency) investors as a group tend to loathe uncertainty. Given the largest Canadian companies in the U.K. operate in heavily regulated sectors and also tend to operate in Europe, having to wait a minimum of two years before regulatory certainty will return is a risk some investors may decide is too great.