Jul 28, 2017

Home Capital's new CEO in the hot seat as Bay Street awaits new strategy

Home Capital Group's analyst community is hoping the embattled lender will provide some clarity on the path forward next Wednesday when it releases its first full quarter of results since being embroiled in a crisis of confidence that caused a run on the lender’s deposits.

Veritas Investment Research analyst Mike Rizvanovic, who has maintained a "sell" rating on the company since he initiated coverage in February, told BNN Home Capital may have made it through the worst, but now it's time to articulate a plan.

Similarly, National Bank analyst Jaeme Gloyn wrote in a note to clients that gaining insight into newly-appointed CEO Yousry Bissada's top priorities will be a focus for the quarter.

Bissada, who has been praised for his extensive experience in the mortgage and financial services industry, officially takes the helm at Home Capital August 3.

However, Gloyn has the equivalent of a “hold” rating on the lender and recommends investors wait until there’s more visibility on some of the macro risks emerging for the company.

"Overall, [his] resume appears strong on paper," Gloyn said in a July 12 note to clients. "We expect the market to adopt a wait and see approach to Mr. Bissada's strategy and execution, which we expect to learn before year-end."

Gloyn also wants to hear how much say Warren Buffet could have in that strategy.

Home Capital surprised the market June 21 when it announced it had lined up one of the world’s most famous investors as a backer, with Berkshire Hathaway investing up to $400 million in the company and providing a $2-billion credit facility.

- Home Capital sheds earlier gains as regulatory concerns weigh

- Home Capital CEO search ends as company picks Yousry Bissada for top job

- Home Capital clears crucial hurdle for Berkshire investment

READ MORE: HOME CAPITAL IN TRANSITION

“How involved is Berkshire in the day-to-day operations?” Gloyn wrote in a separate note.

Home Capital has since completely repaid that loan from Berkshire, but funding costs and deposit rates remain a concern for analysts.

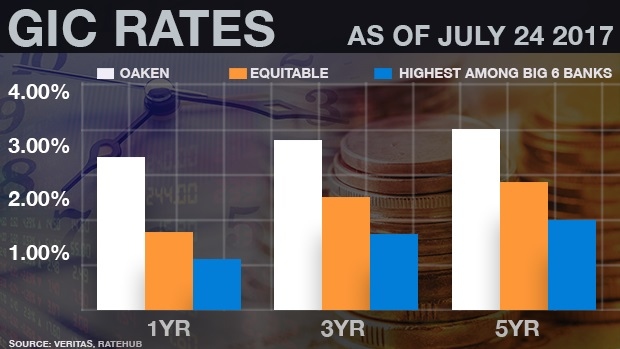

Since the crisis began in April, which was triggered when the Ontario Securities Commission brought forward allegations Home Capital and three former executives misled investors about a probe in 2014 and 2015, Home Capital subsidiary Oaken Financial has had to increase its interest rate on Guaranteed Investment Certificates in a bid to entice jittery consumers to deposit their money with the institution.

Oaken now boasts some of the highest GIC rates in the industry, but some analysts believe the rates will start to decline.

GMP Securities’ Stephen Boland thinks Home Capital’s funding costs may begin to fall more in line with industry norms within the year.

"I think following Q2 results that will start to happen," Boland said in an email to BNN. "They should be able to gradually reduce the GIC rates."

Rizvanovic isn’t so confident.

“More concerning in our view is the possibility that Home Capital ends up with a higher cost structure than other firms in the alternative lending space, Equitable [Bank] in particular,” he said. “That scenario portends a long-term competitive disadvantage for Home Capital, which would surely make it difficult for the company to regain market share in the future without incurring a potentially sizable hit to its margin.”

Adding more wrinkles to Home Capital’s turnaround efforts is the current slowdown in the Greater Toronto housing market and the proposed B-20 guidelines from the Office of the Superintendent of Financial Institutions, which includes expanding stress tests to uninsured borrowers.

Gloyn says he’ll be looking for management’s insight on both fronts, especially their view on how this will affect mortgage origination volumes and profitability.

“It will be a challenge to grow originations if the new [B-20] rules pass. The whole uninsured industry would shift, including the business the banks currently underwrite,” Gloyn said in an email to BNN. “We don’t know how big a shift as yet but it is not positive in our opinion.”

“After surviving a run on its funding, just barely, there is no question that HCG’s earnings power has been permanently impaired. The extent of that impairment remains unclear,” Rizvanovic explained. “We conclude that HCG will not regain anything close to its previous form.”