May 15, 2017

Home Capital won’t need Bank of Canada lifeline: Board director

One of the newest directors at Home Capital Group (HCG.TO) says the embattled alternative lender has bought itself “months” to return to solid footing, but it will likely remain without a permanent CEO for at least the next 45 days.

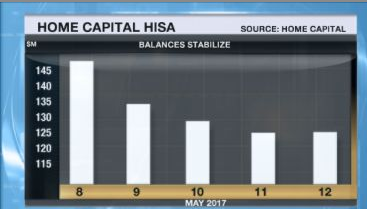

Alan Hibben, a former senior official at Royal Bank of Canada who was appointed to Home Capital’s board earlier this month, says the liquidity crisis at the company has stabilized and he dismissed speculation the company would need to turn to the Bank of Canada for emergency funding.

“We have no intention of taking [Bank of Canada Governor Stephen Poloz’s] money,” Hibben told BNN in his first television interview since joining the Home Capital board. “I think [Finance Minister Bill] Morneau has said this pretty well – there is a market solution for Home Capital. We don’t need to take the Bank of Canada’s money.”

Hibben added the company is focused on finding a new CEO and CFO as well as securing funding to replace the $2-billion emergency lifeline provided by the Healthcare of Ontario Pension Plan (HOOPP).

Home Capital is looking for a CEO with financial services experience and with a solid reputation to help restore confidence in the lender, said Hibben. But it is unlikely the company will be able to hire someone like that in the next 45 days, he said. “If you look at the intersection of who wants to do this, it’s not a big group of people.”

With the company’s financial situation showing some stabilization on Monday, Hibben said he is confident Home Capital will soon be able to find longer term and less expensive financing. “By buying a couple of months of freedom here I can go out in the marketplace and convince people this is a company they should be supporting.”

Hibben added the company is looking to return to a more stable – and more modest – business plan. “There will be a return to stability,” he said. “I’m not sure the company will ever execute on its business plan the way it did in Q1. But it is going to have a robust business plan.”

Hibben would not comment on how much contact Home Capital has with Canadian financial regulators. “I cannot comment on what OSFI is doing or what OSFI is not doing. My lawyer would kill me,” he said.