May 19, 2017

How Canada is unwittingly joining the OPEC-led production cuts

OPEC owes Canada some gratitude.

As the Organization of Petroleum Exporting Countries prepares to extend production cuts coordinated between the cartel and Russia at a meeting next week, the group is hoping other major fossil fuel producers will join their common cause. Earlier this week, the energy ministers of Saudi Arabia and Russia agreed to extend the current cuts through March 2018.

In a joint statement, the two ministers “expressed optimism that a wider circle of countries outside the current group will see the benefit of this cooperation in bringing stability to oil markets, and will join the effort.”

Canada, as one of the world’s largest non-OPEC oil and gas producers, has held back more output than any individual OPEC member in the latest round of cuts since well before the current pact was in place. Based on nearly a dozen estimates collected from top energy investors, industry experts and academics, BNN has determined Canadian oil production would be far higher today were it not for a constant lack of pipeline export capacity over the first half of the past decade.

While the estimates ranged significantly and the analysis is subject to a long list of caveats – pipeline capacity not being the only determinant of production growth and the rise of crude-by-rail being just a couple – most suggested at least an extra 500,000 barrels per day or more would be coming out of Canadian wells today were pipelines built exactly when they were needed. That compares to the world’s largest crude oil producer – Saudi Arabia – agreeing to cut 486,000 barrels of its daily production as its part of the OPEC deal; more than double the volume of cuts from any other OPEC member.

“When you take all of the pipes proposed over the past six years, it amounts to a gross amount of production of about three million barrels per day,” Rafi Tahmazian, partner and portfolio manager at Calgary-based Canoe Financial, told BNN. “It is not unreasonable to think that a pro-pipeline policy would have given us line of sight to about one million barrels of additional production today.”

“That should really be considered our contribution to the OPEC cuts,” Tahmazian said.

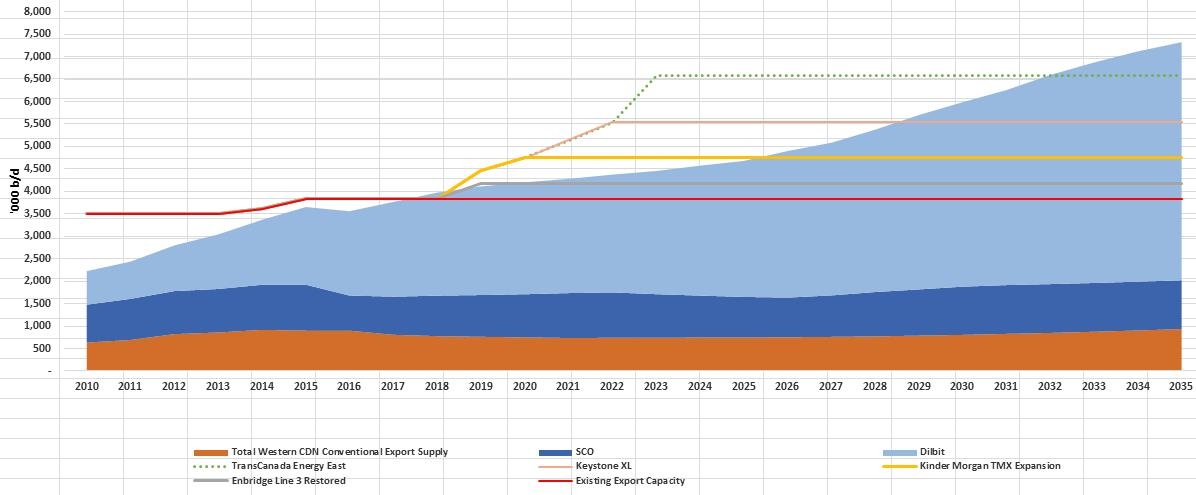

Dinara Millington, vice-president of research at the Canadian Energy Research Institute – while also cautioning constrained pipeline capacity is far from the only factor affecting production growth – told BNN via email how, aside from what may or may not have been produced if pipelines had been built earlier, at least 500,000 bpd in planned oil output growth could be curtailed by 2025 without new export capacity (see the difference between the red and yellow lines in the graph below for reference). Keystone XL and the Trans Mountain expansion are seen as the two pipeline proposals most likely to succeed, but both still face opposition that could prevent them from ever getting built.

If no new pipelines get built over the next 20 years, the graph below shows how even with the addition of crude-by-rail Canadian producers would be forced to leave more than a million barrels of daily production in the ground.

Canadians shouldn’t expect any Thank You cards from the OPEC cartel any time soon, but the Canadian oil and gas sector is likely to benefit from the extension of cuts. That is not just because keeping supplies in check would give demand a chance to catch up, thereby draining some of the record-high crude oil inventories around the world and allowing overall prices to remain stable or even rise.

“Traditionally, OPEC cuts focus first on the medium/heavy sour crudes as these are the lower-price barrels [with a higher production cost],” Dan Tsubouchi, chief market strategist at Calgary-based Stream Asset Financial Management, told BNN via email. “As we have seen in 2017 already, this has helped the heavy/light differential, which is a big win for Canada.”

Often referred to as Canada’s oil sands discount, Canadian heavy oil always trades below the North American benchmark West Texas Intermediate price in part because the thicker peanut-butter-like consistency makes it more expensive to transport and refine, but also due to an ongoing lack of market access. American refineries are mostly designed to process heavier grades of crude despite virtually all American oil production growth being of the lighter, sweeter variety. Much of the heavy oil the United States does not source from Canada comes from OPEC members, meaning if they continue to keep their own heavy oil output low, the demand for Canadian crude would rise and the discount Canadian producers are forced to take would shrink.

“If anything, Canada stands to be one of the bigger winners in continuing OPEC cuts,” Tsubouchi said.

That represents about as close to a thank you as Canadians can expect from the oil cartel for this country’s unwitting – yet ongoing – participation in their coordinated output cuts.