Mar 4, 2019

Largest gold ETF shrinks most in a year as trade tensions ease

, Bloomberg News

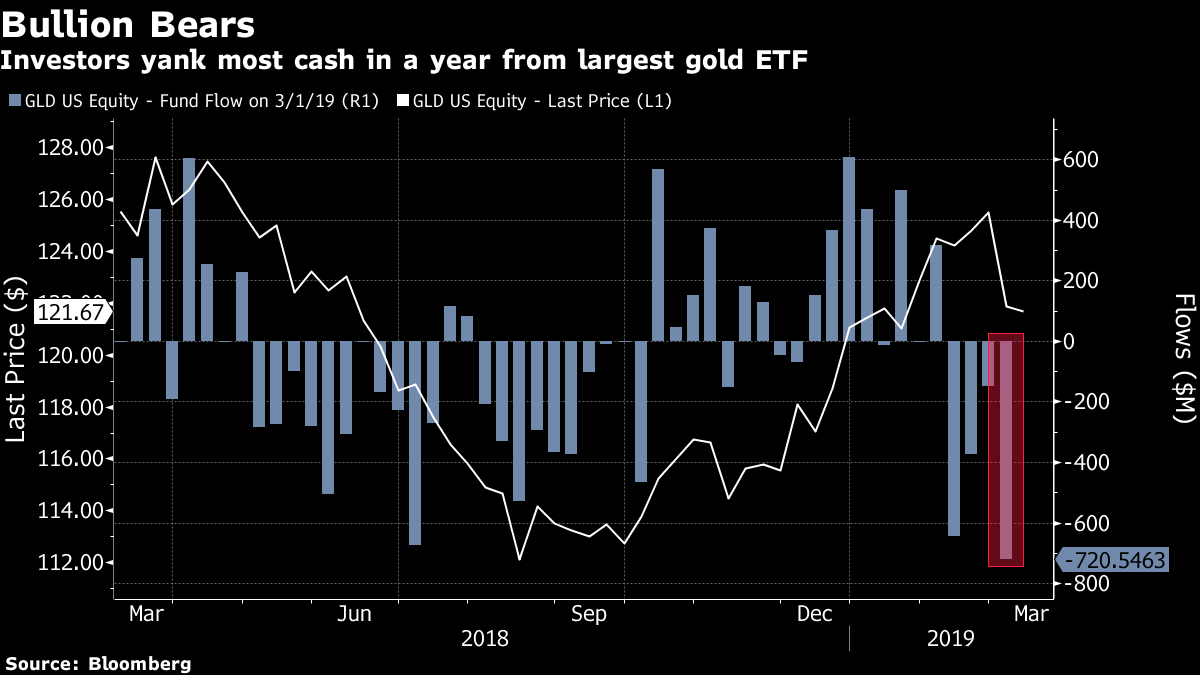

Investors are pulling cash from the world’s largest gold exchange-traded fund at the fastest pace in more than a year as easing trade tensions push buyers out of safe-haven assets.

The US$33 billion SPDR Gold Shares ETF, or GLD, saw a net withdrawal of US$496 million on Friday, the most in a single day since February 2018. That pushed the five-day total to US$720 million, marking the fourth consecutive week of outflows.

Investors are weighing the prospect of a trade deal that could lift most or all U.S. tariffs, boosting risk appetite and dimming the appeal of havens. Commerzbank AG analysts including Carsten Fritsch attributed flows out of GLD and a dip in bullion prices below US$1,300 an ounce to “good sentiment” in a research note. A strengthening dollar and a rebound in the equity market also eroded demand for bullion.

“Gold is thought to be a safe haven, particularly during pullbacks, anticipated downtrends and market volatility,” said Sylvia Jablonski, head of capital markets at Direxion, which specializes in leveraged ETFs. “We are hearing positive news on the anticipated progress between President Xi and Trump, which may lead some investors to perhaps consider risk and reduce -- or not add -- additional gold exposure in the near term.”

ETFs tracking gold miners have also lost cash lately. Investors pulled US$148 million from the VanEck Vectors Gold Miners ETF and US$142 million from the VanEck Vectors Junior Gold Miners ETF last week.