Nov 27, 2017

Larry Berman: Financial planning for the future of AI and robo-advisors

By Larry Berman

Last week was financial planning week. Launched in 2009, an integral part of Financial Literacy Month, Financial Planning Week is part of an ongoing effort by Financial Planning Standards Council (FPSC) and the Institut Québécois de Planification Financière (IQPF) to raise awareness of financial planning as fundamental to the financial well-being of Canadians. This week’s guest is Cary List, president and CEO of The Financial Planning Standards Council of Canada.

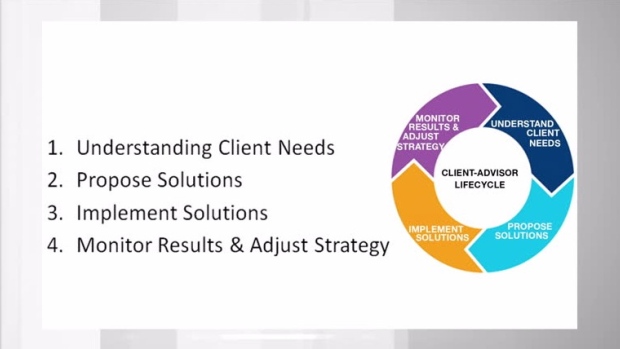

The most exciting area of growth in financial services has to be fintech. The most disruptive area for the consumer is likely robo-advising. Robo-advisors using fintech are making great progress, but consumers are not responding yet. According to the FPSC, there are four pillars to the client-advisor lifecyle:

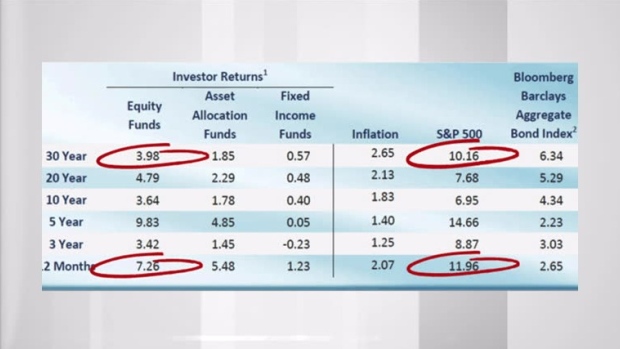

In the robo-advising world: Artificial intelligence is playing an increasingly important role. There are some things that AI does very well and others that are more of a challenge. Overall, it is reducing the cost of investing to the end client. And while this is great, the biggest cost of investing is the emotional one. DALBAR, a U.S.-based consultant, estimates that the emotional cost of investing is about 500 bps per year when they factor in all the emotionally driven buy and sell decisions of mutual funds and ETFs.

In terms of understanding clients need: Fintech (AI) does a decent job today and in the future will likely outperform human advisors. Where fintech is weaker now is in the ability to follow up and probe based on experience. However, deep learning algorithms will learn how to do this in the future. According to this study, expectations are that they will never be as good as humans. I’m not so sure. They say robotics voice patterns are getting so good, that within a year, you will not be able to distinguish a robo conversation with a real human.

In terms of recommendations or proposals: The future looks bright as computers will be excellent at these tasks. Where it is expected to fall a bit short is on customization. Complex insurance needs seems like it would be difficult for a computer to facilitate, though I believe that will come in time too.

Implementation today in terms of opening accounts is excellent: Transferring assets is improving, but still needs a good degree of human touch. Where human advisors may always have a roll is for validating the recommended strategy. It may take decades for people to fully trust a computer with their retirement savings. People may just want to talk to someone on a regular basis. Would they care if they are talking to an AI client service bot?

And finally, monitoring and adjusting so that your long-term goals are always met. The computer is pretty good at rebalancing portfolios today and is expected to improve significantly. But where the computer may never work well is the ability to keep clients calm in a difficult market. Remember, according to DALBAR, measures all the buying and selling that happens, the emotional cost of investing is the highest. You will never see a robo-advisor refuse to sell your portfolio at your request, though they may send you emails and advice not to do it. Again here, would that emotionally meaningful conversation ever take place with an AI bot? Not with my money any time soon, but it’s coming. Personal assistants like Alexa, Siri, Cortana and Bixby are already helping and building trust with people.

If you want to learn how to make better investment decisions and how to avoid some of the poor emotional decisions that we make, come out to the current Berman’s Call tour (investor’s guide to thriving). You will learn about some of the behavioural biases that might be hurting your investment returns and learn how a bit more about how to properly diversify your portfolios, which most individual investors do not do very well. Learn how to identify what type of investor you are and some techniques to improve how to manage your asset allocation so you can preserve and grow your portfolio. The events are free and we ask for a voluntary charitable donation to either Sick Kids Hospital or Baycrest Brain Health research for Alzheimer’s. Visit www.etfcm.com or Bermanscall.com to register.

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com