Mar 4, 2019

Larry Berman: Metals and late economic cycles

By Larry Berman

In keeping with this week’s PDAC conference, I thought I’d take a look at base metals ETFs.

It’s a sector that is extremely cyclical and can be hot or not for extended periods. The first global base metals ETF was the SPDR equal weight Metals & Mining ETF (XME). The major sectors include iron and steel, mining commodities like copper, zinc and nickel, and coal.

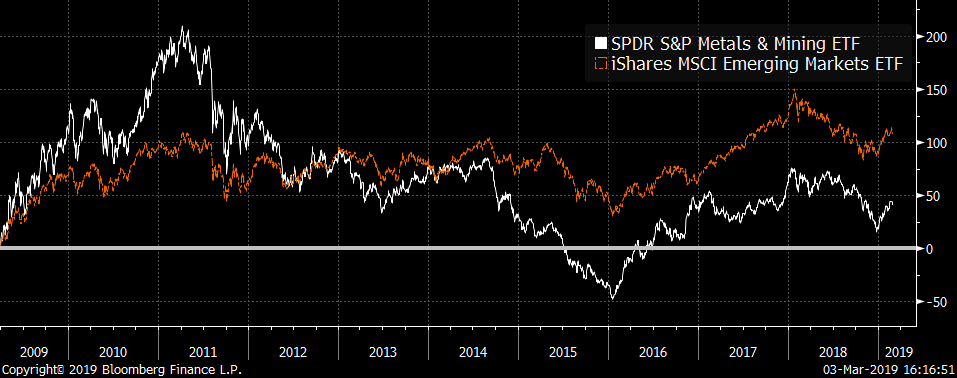

The sector tends to do well when China and emerging markets are doing well and poorly when they are weak. The correlations are quite strong. The biggest growth areas of the world are in emerging markets, so it makes sense. So, with the outlook for the global mining sector tied to growth in those markets - and we know China is decelerating - we should not expect robust rallies in the coming years.

The sector can also act like an inflation hedge. The Fed has said recently that they are considering using a higher target for inflation (of above two per cent). Here we need to keep and eye on the Fed’s favourite inflation measure: Core personal consumption expenditures (PCE) of GDP. This could be a bullish catalyst for the base metals mining sector.

One major headwind, according to the World Bank, is that China’s population is expected to peak within the next decade and growth over the past decade has largely been fueled by massive increases in leverage (debt). So while Chinese stimulus can cause strong periods of growth, I am not bullish on China and expect growth to continue to slow towards three-to-four per cent in the coming years.

For the three main sectors, copper and base metals mining tends to lead on the upside, while steel is almost always strong when growth in emerging markets is improving. The one sector that will probably continue to lag is coal.

My conclusion is to buy dips and wait until after the next global recession to play out before investing longer term in the sector. This does not mean you can’t trade the sector and play for a rally for a few months on Chinese trade resolutions. I currently have no direct exposure to the sectors. I prefer gold to play the inflation theme.

--

Berman Live: Learn to Sleep at Night in a Bear Market

The previous Investor’s Guide to Thriving tour wrapped up on Dec. 1, 2018. Aptly named “How Long Can a Bull Market Run?” we may have received our answer. The market had its worst December since the Great Depression – bringing most of the major indices officially into bear market territory. Markets rebounded in January as they always do after steep declines, but we are likely in the early phases of a bear market where average corrections are closer to 30 per cent and extreme corrections are more than 50 per cent.

If this is case, we haven’t seen the last of market volatility and a downward pattern of lower highs and lower lows. Many people are surprised at this phase because it can take some time for the fallout to move from Wall Street to Main Street – showing up as a recession. Job markets are relative robust still and central banks are still talking about raising rates. Markets are forward-looking and generally anticipate economic downturns, so even as rates continue to rise, employment appears to be strong, and many companies are still posting record earnings – you should be paying attention to the growing cracks in the system.

A more detailed tour of past bear markets should help us see what we can learn about how this next one might compare. Will it be a gentle panda or a deadly grizzly? Can we hope for a soft landing due to aggressive government policy? How would we recognize a market bottom and when the next major bull market might begin? Why not go to cash or put all your money into a GIC right now? There are many questions to ask – and while I don’t have a crystal ball to give you the definitive answers, I can show you how to navigate a bear market so that you will use it as an opportunity rather than something to fear. Using some of my favourite indicators and techniques, you will learn how to use a tactical approach to trading, and strategic asset allocation (including the use of gold, real assets, and other non-equity vehicles), to help keep your portfolio within your emotional comfort zone – while avoiding costly emotional mistakes. Success in difficult markets is both a science and an art, so I will also discuss the psychological aspect of managing portfolios under stressful conditions.

This live presentation a timely perspective on how to approach your investments in 2019 and beyond – along with actionable ideas to help strengthen your portfolio, and even a few tools and resources to use at home. Sign up at www.etfcm.com

SEE LARRY LIVE

| City | Date |

|---|---|

| Saskatoon, Sask. | Wed. March 6 |

| Winnipeg, Man. | Thu. March 7 |

| Toronto, Ont. (Queensway) | Sat. March 9 |

| Kelowna, B.C. | Wed. March 13 |

| Victoria, B.C. | Thu. March 14 |

| Vancouver, B.C. | Sat. March 16 |

| London, Ont. | Wed. March 20 |

| Halifax, N.S. | Thu. March 28 |

| Markham, Ont. | Sat. March 31 |

| Montreal, Que. | Thu. April 11 |

| Ottawa, Ont. | Sat. April 13 |

| Edmonton, Alta. | Wed. April 24 |

| Calgary, Alta. | Sat. April 27 |

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com