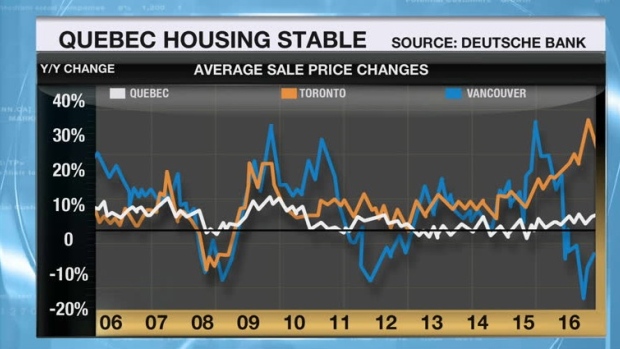

Quebec’s finance minister believes his province is “light years away” from the hot housing markets that exist in Toronto and Vancouver.

While the Montreal housing market has already seen six per cent price growth in 2017, Carlos Leitao believes there’s no reason to sound the alarm just yet.

“We are still light years away from a situation that you see in Toronto or Vancouver,” Leitao told BNN in an interview on Friday. “Our level of prices is still, very, very affordable and our rate of growth in pricing, it’s improving, but it’s still well within reason.”

“What we’ve seen in both sales volume and in price growth reflects a balanced market, reflects good balance between supply and demand. This is not at all reason to worry… it confirms our optimism in the economy moving forward.”

The six per cent growth is a significant shift from the one per cent growth projected by the Montreal Real Estate Board at the start of the year, but Leitao believes those projections overestimated the effect Canada’s newly-instituted mortgage rule changes would have on the market.

“I think those original forecasts were overly pessimistic because they were assuming that there was going to be a big adjustment to the new mortgage rules,” he said.

“We always thought that those new mortgage rules are necessary and that it would have some impact on the market, but I never believed that in a city like Montreal that the impact of those new mortgage rules would be that negative.”

As for what’s driving the market, Leitao believes that the uptick in housing interest – not just in Montreal but in cities across Canada – can’t be boiled down solely to interest from foreign buyers. He says targeting them is not a standalone solution to cooling real estate prices.

“If we only think of housing speculation in terms of foreign buyers, we are missing the boat. Housing market speculation is usually driven primarily by local residents,” Leitao told BNN.

“Sure, foreigners may at some point contribute to that movement, but they are not the only answer. So, when we approach the issue of housing market speculation we have to look at it in a much broader range of issues than just focusing on foreigners.”