Mar 5, 2019

Mystery buyer buoys emerging-market ETF in biggest trade of the year

, Bloomberg News

One investor just placed a big bet on emerging markets at a time when some of the largest banks are signaling threats to this year’s rally.

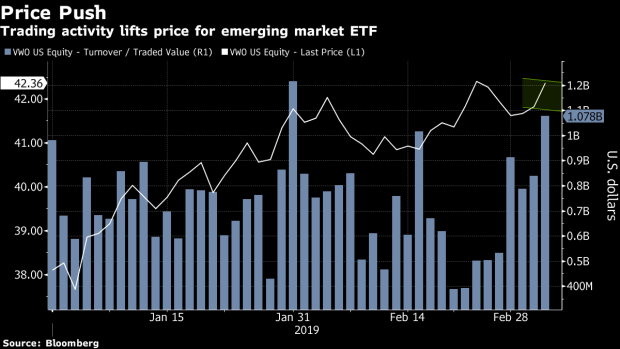

A trade of about US$211 million, or five million shares, of the Vanguard FTSE Emerging Markets ETF was recorded at 11:45 a.m. in New York Tuesday. That’s the largest trade for the exchange-traded fund in 2019, according to data compiled by Bloomberg. The ETF climbed for a third day.

The purchase comes amid bank warnings that a China growth slowdown, a stronger dollar and uncertain trade talks could upend the best start to a year for emerging-market equities since 2012. One of JPMorgan Asset Management’s biggest mutual funds reduced its stock exposure last month, while Goldman Sachs Group Inc. advised clients to be selective. UBS Wealth Management said it took profits on some of its developing-world wagers in late January.

“I guess someone is buying the dip,” said Whitney Baker, the founder of New York-based Totem Macro, which advises funds holding more than US$3 trillion in assets. “Our conviction in the broad theme of EM outperformance at the end of the developed-market cycle hasn’t changed.”