UBS Analyst Who Took On Evergrande Now Bullish on China Property

When it comes to Chinese real estate, John Lam is a lone wolf.

Latest Videos

The information you requested is not available at this time, please check back again soon.

When it comes to Chinese real estate, John Lam is a lone wolf.

Analysts upgraded their forecast for China’s growth this year after a better-than-expected performance in the first quarter — but they see more signs that the world’s second-biggest economy will struggle to escape from deflationary pressures.

A rash of failures of A-rated insurers points to a hidden weakness in the market, researchers say.

Whirlpool Corp., the owner of the Maytag and Amana appliance brands, is cutting about 1,000 salaried positions worldwide to reduce costs as slow US home sales limit demand.

Chicago Bears officials alongside Mayor Brandon Johnson unveiled plans for a $4.7 billion project to build a publicly owned, enclosed stadium and enhanced lakefront area.

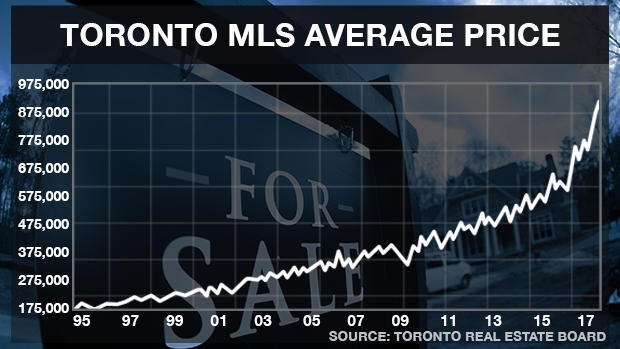

Apr 17, 2017

By Greg Bonnell

Calls for action on runaway Toronto home prices are at a fever pitch, with several options on the table but no “silver bullet” for politicians meeting Tuesday to form a battle plan.

From taxing foreign buyers to targeting vacant homes and property flippers, it all boils down to who’s going to fix the situation -- and what levers they’ll pull.

While Canada’s central bank is pointing to speculation as a driving force, Governor Stephen Poloz is making it clear it’s not the Bank of Canada’s job to cool the market through higher rates.

Enter the politicians.

Federal Finance Minister Bill Morneau, his Ontario counterpart Charles Sousa, and Toronto Mayor John Tory will emerge from a housing policy meeting Tuesday afternoon to a barrage of questions about their next move.

“Arguably, the most effective steps to cool the housing market would involve all levels of government, so it's encouraging they are meeting,” BMO Capital Markets Chief Economist Doug Porter told BNN in an email.

“Probably the most effective lever to pull would be more than one.

First, they have to identify the problem.

Speculation appears to be public enemy No. 1 for Sousa, who accuses “property scalpers” of crowding Ontario families out of the housing market.

Scotiabank Chief Economist Jean-François Perrault calls speculation the “primary issue at this time” in the Greater Toronto Area. You could increase supply to keep up with that demand, but it would take time to have an impact.

“We need something to temper speculative activity in the shorter-run,” Perrault wrote in an email to BNN. “A tax of some kind on speculative activity would be the best approach to cool the market.”

Sousa, who has said on several occasions that there’s no “silver bullet” or easy answer, has been pushing Morneau to act on home flippers by using the rules around capital gains taxes.

“Increasing the capital gains inclusion rate of 50 per cent on the sale of residential housing that does not qualify for the principal residence exemption could reduce the incentive for people to make speculative purchases,” Sousa wrote in a March 17 letter to Morneau.

That approach is not without its challenges. “First and foremost homeowners and flippers are not declaring properties they sell as non-primary residences,” said Perrault.

The current rules around property sales on a non-primary residence do allow for 100 per cent of a profit to be subject to tax if the Canada Revenue Agency determines – using a handful of criteria – that the profit earned is business income rather than a capital gain.

In short, enforcing and utilizing the existing rules could go a long way.

When it comes to a vacant home tax, CIBC Capital Markets Chief Economist Avery Shenfeld notes it’s “difficult to enforce.”

Measures to improve supply, Shenfeld argues, “would be a win-win, since they both cool prices and add to GDP growth during the construction phase.”

And then there’s the foreign buyer, the source of so much consternation despite incomplete data on just how influential they are in the market. Ontario hasn’t ruled out a tax on this front.

“The Vancouver experience is not clear-cut on the effects of such a tax,” noted Perrault.

Indeed, while Vancouver home sales fell off a cliff after a foreign buyer tax was imposed, many argue the market was already in decline – having simply exhausted itself.

If and when politicians decide on a solution, the timeline for cooling the market will depend on the measures taken. Taxes can have a fairly quick effect, while increasing supply through building is clearly a longer-term solution. Regardless, the market isn’t convinced the policymakers will make the right move.

“The problem is I’m not so sure they’re well-suited to make smart decisions,” Baskin Wealth Management Chief Investment Officer Barry Schwartz told BNN, “because they [the politicians] have let it go for so long.”