Feb 8, 2017

Oil sands an underappreciated investment opportunity: BMO

By Tara Weber

Canada’s oil patch “may be on the cusp of a new investment cycle” as oil settles into a US$50-60/bbl range, according to a new report from the Bank of Montreal.

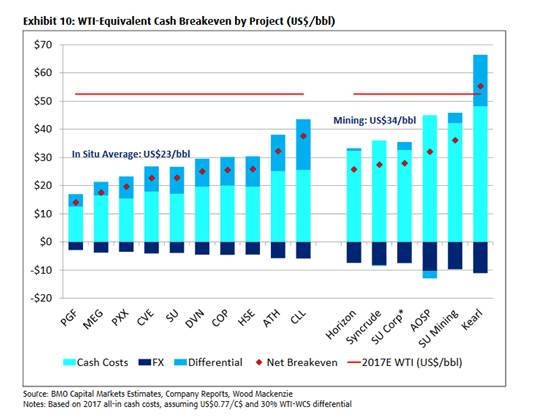

Its numbers show many companies in the oil sands industry can remain economically viable in this US$50/bbl world, with the ability to stay cash positive and hold their production levels for many years to come. The cash breakeven costs on a WTI-equivalent basis are roughly US$23/bbl for in-situ projects, and US$34/bbl for mining developments, according to the report.

BMO's calculations take into account exchange rates, light-heavy spreads, and quality/location differentials.

The in-situ projects with the lowest cash breakeven points include conventional heavy-thermal oil operations at Pengrowth's Lindbergh and BlackPearl's Onion Lake projects, as well as SAGD operations at Christina Lake run by MEG Energy and Cenovus. Those projects range in cost between US$14-22/bbl.

The lowest cash costs in mining operations come in at US$26-28/bbl at Canadian Natural Resources’ Horizon project and the Syncrude project.

The performance of assets varies greatly based on a combination of asset quality and operator experience, according to the report. BMO suggests investors focus on oil sands operations with high-quality assets, strongest balance sheets, and greatest potential for cash flow when the price of oil remains flat. Based on those criteria, BMO's top recommendations are Canadian Natural Resources and Suncor Energy.

BMO states that oil sands economics are now competitive with tight oil, commonly known as shale oil.

"The oil sands industry may be on the cusp of a new investment cycle," wrote Randy Ollenberger, the report’s co-author. "With lower costs and new technologies, we believe oil sands investments can

generate investment performance similar to tight oil when viewed on a full-cycle, comparable basis.”

While oil sands investment requires a high level of capital upfront, its costs are much smaller thereafter to sustain production for decades. In comparison, tight oil wells require continual investment over the years to sustain production. Thus, over a 30 year period, they yield similar performance.

Although existing oil sands projects are viable at US$50/bbl, many new oil sands projects require the price of oil to increase to the range of US$55-65/bbl. "We believe that new SAGD projects generate better returns on capital than new mining investments, with brownfield expansions offering superior returns over greenfield projects," Ollenberger said.

Despite the increase seen in capital spending by many companies in the oil patch, BMO expects oil sands capital spending to fall 7 per cent in 2017 and a further 29 per cent in 2018 as the last wave of planned construction fades.

Even as capital spending continues to decline as multi-year projects end, a combination of expected stronger oil prices and growth could result in an increase in free cash flow, according to BMO. It estimates an increase of roughly 70 per cent over last year's levels -- roughly $33 billion this year and more than $38 billion in 2018. That extra cash may result in companies resuming investment.