Jul 14, 2017

Personal Investor: Advisors face deadline to come clean on fees

By Dale Jackson

Where did the decade go? After 10 years of industry foot-dragging, the deadline for investment advisor firms to comply with new disclosure rules - known as CRM2 - has come.

The whole effort started in response to independent reports from research firms like Morningstar Canada that showed Canadians pay the highest investment fees in the developed world.

We still pay the highest fees. Now we can witness a portion of the shock and horror of what they really are.

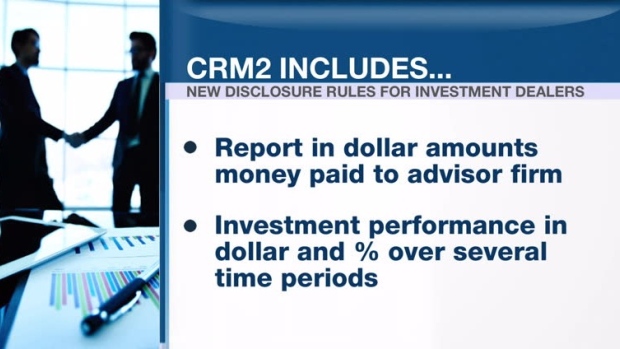

Investment dealers must now disclose advisory fees in dollar amounts as well as the normal practice of disclosing them as a percentage. It’s easy to see why advisors dreaded this day when you consider a typical one per cent annual advisor fee on a $400,000 portfolio of mutual funds comes to $4,000 a year. That fee doesn’t include other advisor compensation such as loads when a fund is bought or sold. Imagine opening your holiday bills in January and seeing that whopper.

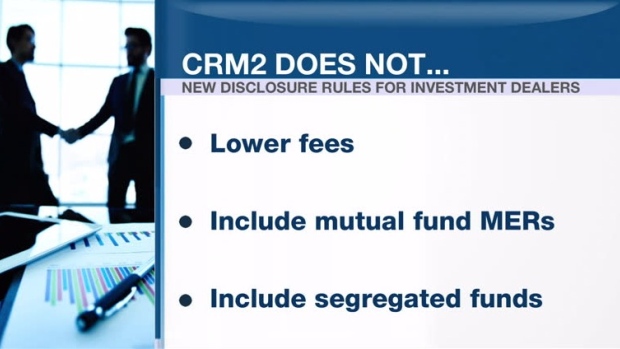

Even worse, what investors will be seeing is just the tip of the iceberg. Excluded from the dollar-fee disclosure rules is the annual fee mutual fund companies charge known as the management expense ratio (MER). Using the same $400,000 mutual fund portfolio as an example a typical MER of 2.5 per cent results in a $10,000 fee each year. About one per cent of that is the advisor fee but $6,000 remains undisclosed as a dollar amount. Think of how much that $10,000 could grow over time if it remained invested.

Higher fee segregated funds – mutual funds with a guarantee on the principal – are exempt from CRM2 because they are considered insurance products.

The industry is touting CRM2 as the first step toward fuller disclosure, but that depends on how investors react. According to a poll conducted prior to CRM2 by Tangerine Investments, 83 per cent of Canadian investors surveyed were not aware that the new information would be included in their reports. Of those who did know they pay fees to invest, 48 per cent did not know how much they pay in dollar amounts.

If knowledge is power, investors at least have some power to bring down investment fees.