Jan 17, 2018

Personal Investor: Brighter days ahead for savers

By Dale Jackson

Remember the good old days when it paid to save? They’re not here yet – but they are coming back.

The latest Bank of Canada interest rate increase is part of a broader trend thawing borrowing rates from the 2008 global financial freeze.

Investment advisors always recommend a portion of any portfolio go into fixed income, but meeting retirement goals with paltry yields has been challenging. The low-rate environment has been pushing investors to riskier income generators like dividend stocks, preferred shares, fixed-income mutual funds, and bond exchange trade funds (ETF).

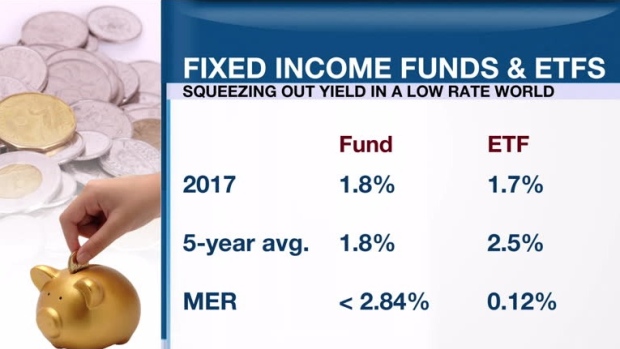

Where the advisors disagree is whether fixed-income mutual funds and bond ETFs are actually fixed income. Their prices fluctuate at least daily, which makes them far from fixed. In 2017 the average Canadian fixed-income mutual fund returned 1.8 per cent – consistent with the five-year average. That’s after mangers took their cut in the form of a management expense ratio (MER), which could be as high as 2.84 per cent of the total assets invested.

In comparison, the iShares High Quality Canadian Bond Index ETF (XQB) returned 1.7 per cent last year but has returned 2.5 per cent annually over the past five years. The MER is only 0.12 per cent, which probably explains the extra yield.

Other advisors say real fixed income is just that: fixed. While the trend toward higher yields has hardly budged returns on longer-term bonds, yields on shorter-term fixed income such as guaranteed investment certificates (GICs) have finally risen above two per cent.

Their advice is to stay with short terms and ladder maturity dates to provide more opportunities to get the best going rates as they rise over time.