Jun 23, 2017

Home Capital sparks GIC bonanza

By Dale Jackson

Everybody loves Warren Buffett for coming to the rescue of embattled Home Capital Group (HCG.TO). Well, not everybody.

Home Capital’s gain could be a loss for savers who have a rare opportunity to benefit from the mortgage lender’s financial uncertainty. Lenders need to borrow and Home Capital has had to pay lenders dearly to put money in their guaranteed investment certificates (GIC). The thing is; GICs are ultimately backed by the federal government up to $100,000. Realistically, there is no risk. It’s a no-brainer.

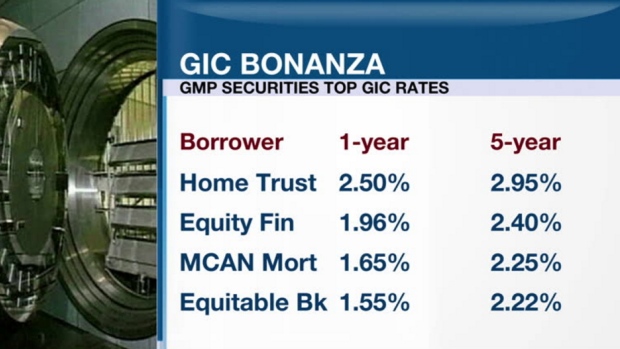

The perception of risk has other lenders boosting their GIC rates to compete. In some cases they are paying out more to creditors than they are taking in from borrowers - turning the tables on the bank profit model. Below is a chart of current GIC rates from Joey Mack, director of fixed income at GMP Securities. When you look at them keep in mind mortgage rate website Ratehub.ca currently posts five-year fixed rate mortgages as low as 2.4 per cent.

- Personal Investor: CRA cracking down on TFSA ‘winners’

- Personal Investor: Higher rates a wake-up call for investors

- Personal Investor: Stakes are high for margin investors

MORE FROM YOUR PERSONAL INVESTOR

Before you jump at the highest rate, keep in mind most bond traders and investment advisors are leery about long maturity dates. With overall interest rates on the rise, a three per cent GIC rate might not be so appealing over the next five years. A shorter term, laddered with other maturity dates in your portfolio, will create more opportunities to take advantage of the best rates when they mature.

Also, GICs are ideal for registered retirement savings plans (RRSP) and tax free savings accounts (TFSA). Interest accumulated on GICs outside either plan is fully taxed. In an RRSP the principal can be deducted from your income and it can grow tax-free until it is withdrawn. In a TFSA it is never taxed.