Dec 13, 2017

Personal Investor: Investing with your conscience can pay off

By Dale Jackson

If your New Year’s resolution is to make the world a better place, consider starting with your own investment portfolio.

The formal term is socially responsible investing, or SRI, and there are many products that reflect the wide range of views on ethical investments.

The most popular SRI strategies avoid investments involved in tobacco, weapons, alcohol, gambling, pornography, environmental damage or oppressive regimes. That’s pretty broad and subject to individual interpretation. Some investors might consider any oil and gas company unethical or might want to exclude specific companies with questionable practices.

Mutual funds and exchange-traded funds – the most popular investment vehicles for Canadian retail investors – often don’t disclose all their holdings and they can change from day to day.

The first step is to talk with your investment advisor. Most firms have a form you can fill out with specific instructions. Many mutual fund companies offer SRI funds and there is a vast array of ETFs with ethical and religious guidelines that could match yours.

Many of those funds are sub-advised by a Toronto-based research firm called Jantzi-Sustainalytics. Jantzi works with fund providers or pension plans to provide a screening process in line with their wishes. Jantzi also offers the 60-company Jantzi Social Index as an SRI-screened version of the S&P/TSX 60 index, considering a wide array of social criteria and excluding companies that have “significant involvement in nuclear power, tobacco and weapons-related contracting”.

When it comes to performance there is no proven correlation between ethical investments and the broader markets, but it stands to reason that having fewer options means fewer opportunities.

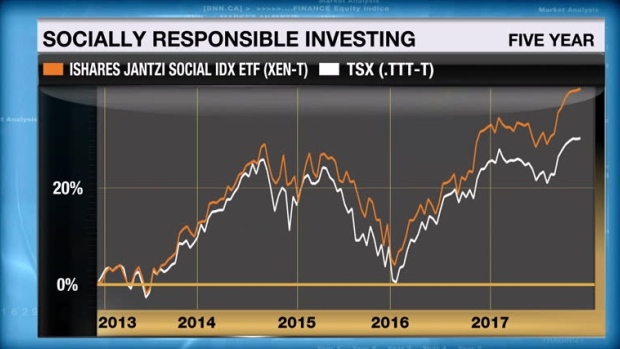

It is, however, curious to note the ETF that tracks the Jantzi Social Index (XEN.TO) has an average annual return of 9.7 per cent over the past five years - even after you strip out the 0.55 per cent management expense ratio.

Over the same period the TSX Total Return Index returned 8.8 per cent.