Jun 28, 2017

Personal Investor: What to do if your advisor changes firms

By Dale Jackson

The relationship between investment advisors and their clients is changing. Exchange-traded funds and robo-advisors have empowered do-it-yourself investors, and the latest fee disclosure rules are jolting clients into the realization that Canadians pay the highest advisor fees in the developed world.

Industry insiders say the latest changes have many advisors on the move – moving to other firms, starting their own firms or just getting out of the business.

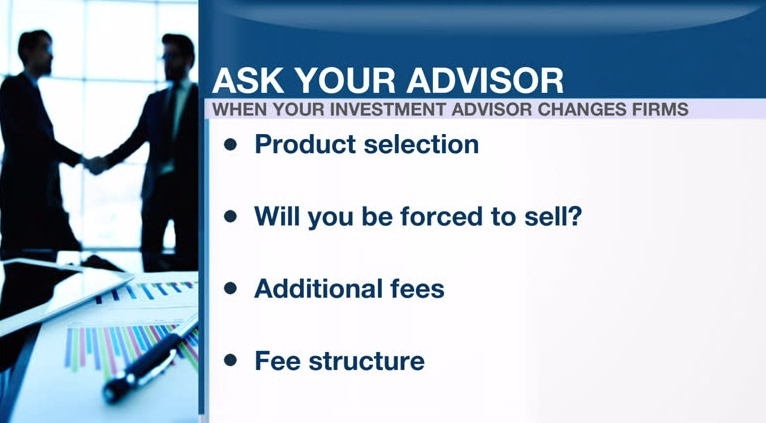

So, what should you do if your advisor announces he or she is moving on and wants you to follow? Here are some questions you should ask:

Is it the individual advisor that has kept you as a client or is it the firm? Has the advisor been implementing company guidelines or applying their own skills? Is the new firm better?

Will the same investment strategy be applied? Some investment firms implement their own investment styles that might not be good for you.

Will their client list be increased or attention be pushed to higher net-worth clients? The bigger the client list, the less time for individual attention

- How will the quality of research change? Big firms tend to have big research departments with experts around the world. Some also provide estate and tax planning services.

- Do they have a wide selection of investment products or are they confined to promoting proprietary products offered only by that company? How good are those products?

- Will you be forced to sell existing investments to comply with the new firm’s offering?

- Will you get hit with addition fees to leave one firm and join the other, such as closing costs and transfer fees?

- Is the fee structure changing? Some advisors work on commission, some are fee based and some are entirely different. Consider how the fee structure might impact your advisor’s incentive to work in your best interest.