Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

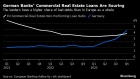

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Jul 19, 2017

By Greg Bonnell

Extending tougher mortgage rules to all borrowers is a bigger risk to the housing market than higher rates and policymakers might want to rethink such a move, according to one of Bay Street’s most prominent economists.

With the Bank of Canada raising interest rates last week for the first time in nearly seven years, the spotlight is squarely on record high debt and the ability of Canadians to afford their monthly payments.

Meantime, the country’s banking regulator is taking aim at the uninsured mortgage market – where homeowners make a down payment of 20 per cent or more. It’s proposing stringent stress tests for those borrowers, in line with what’s already happening in the insured market.

In a new report, CIBC Deputy Chief Economist Benjamin Tal argues the Bank of Canada is “not oblivious to the fact” that borrowers are highly sensitive to rate increases.

“The increased sensitivity to higher rates will prevent the bank from moving too rapidly,” Tal wrote in the report.

“The more immediate risk is the proposed rate qualification regulatory changes, which we believe have the potential to notably slow down growth in mortgage originations.”

In the report, Tal warns that a slowdown in consumer spending and the housing market could bring on a recession.

RELATED ITEMS

The last hot market left standing until this spring, Toronto, is already in rapid cool-down mode following government intervention. Sales have plunged and the average sale price is down 14 per cent from the record highs of April.

“Given current momentum in the market, it might be advisable to rethink the timing” of new stress tests for uninsured mortgages, according to Tal.

Mortgage market expert Rob McLister echoed that sentiment, arguing that “regulators could be playing with fire.”

“This could easily be one of the most impactful mortgage restrictions of all time,” McLister, founder of RateSpy.com, told BNN in an email.

Roughly four in every five mortgages in Canada are conventional, uninsured loans and the big banks dominate the market. If OSFI expands the stress test as planned, McLister reckons those conventional buyers could see their purchasing power slashed by 18 per cent.

“As we've seen time and time again, onerous mortgage regulations aren't necessarily a death knell for housing,” said McLister.

“But if housing does dive because of OSFI's move, not only will policymakers and our real estate-dependent economy get burnt, but so will anyone who relies on home equity.”