Apr 2, 2019

Pot ETFs make millions from short sellers for year’s best gains

, Bloomberg News

Exchange-traded funds that invest in cannabis companies are hitting the jackpot with a little help from short sellers.

The two largest pot ETFs in North America -- the Horizons Marijuana Life Sciences Index ETF (HMMJ.TO) and the ETFMG Alternative Harvest ETF -- have made millions of dollars lending out their holdings to traders who want to bet against this year’s 60 per cent climb in the red-hot market for cannabis stocks. Both funds returned more than 45 per cent in the first quarter, beating almost all non-leveraged ETFs in North America, data compiled by Bloomberg show.

While many ETFs engage in securities lending, it’s been a particularly lucrative practice for pot funds as many cannabis stocks have a small public float and aren’t readily available to borrow. Pot securities cost about 15 per cent to borrow versus typical rates closer to 1 per cent for more prosaic shares, according Bloomberg Intelligence analysis. But borrow fees can rise to as high as 110 per cent for popular short targets like Tilray Inc. (TRLY.O)

“There’s a lot of people that don’t believe in this sector from a long-term growth perspective and are trading on that volatility,” Steve Hawkins, president and chief executive of Horizons ETFs Management Canada, said on Bloomberg TV last week. “They’re coming to us because we are the largest institutional holder of a lot of these companies.”

Canadian ETFs can lend out as much as 50 per cent of their holdings, while U.S. funds are capped at 33 per cent, according to Bloomberg Intelligence.

Best Performers

The Horizons fund -- the first pot ETF and Canada’s biggest -- gained 53 per cent in the first quarter, making it one of North America’s best-performing ETFs.

Securities lending boosted its performance by approximately 1.1 percentage point in the first two months of the year, translating into a 7 per cent yield on an annualized basis, a Horizons ETFs spokesman said. The fund, known as HMMJ, netted $51.5 million lending out its stocks to short sellers last year, with $16.8 million of that coming in the fourth quarter, the issuer said.

ETFMG Alternative Harvest ETF, known by its ticker MJ, has also reaped the benefits of securities lending. The fund gained 46 per cent in the first quarter, more than any other unleveraged U.S. fund, data compiled by Bloomberg show.

Income from short sellers added 0.58 percentage point to MJ’s overall performance in the first three months of the year, according to Sam Masucci, chief executive of ETF Managers Group, which runs the fund. Securities lending generated about 2 percentage points -- more than US$9 million -- for MJ’s shareholders in 2018, Masucci said.

‘Double Whammy’

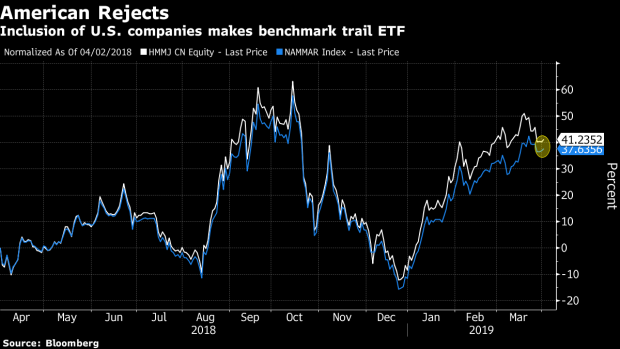

Securities lending is however only part of the story, according to Bloomberg Intelligence analyst Eric Balchunas. Neither HMMJ nor MJ own U.S. pot stocks as such businesses are illegal under federal law. With these cannabis producers lagging over the last year, that’s helped HMMJ beat the North American Marijuana Index -- which covers Canadian and U.S. companies -- but that advantage could fade.

“These funds have the double positive whammy of securities lending and U.S. pot stocks trailing Canadian ones,” said Bloomberg’s Balchunas. “If U.S. pot stocks rally, it’s possible some of this boost goes away, because the securities lending benefits may be overwhelmed by the funds not holding the U.S. stocks.”

Cannabis Canada is BNN Bloomberg’s in-depth series exploring the stunning formation of the entirely new – and controversial – Canadian recreational marijuana industry. Read more from the special series here and subscribe to our Cannabis Canada newsletter to have the latest marijuana news delivered directly to your inbox every day.