Sep 14, 2017

'We still have miles to go': Sobeys' parent surges on first-quarter beat

After years of struggling under the weight of its blockbuster Safeway takeover, optimism is picking up at Sobeys' parent company. But CEO Michael Medline doesn’t want to get ahead of himself.

Empire Co. (EMPa.TO) sailed past profit expectations in its fiscal first quarter, as adjusted earnings jumped 18.9 per cent to 32 cents per share. Analysts, on average, were expecting 22 cents. Sales also topped estimates in the period at $6.27 billion amid an uptick in same-store sales.

“You won't be hearing any champagne corks popping over here,” Medline said on a conference call Thursday morning. “We still have significant work to do in all facets of our business.”

The former Canadian Tire chief executive inherited a daunting task when he was appointed to the top job at Empire Company in January: Clean up a disastrous integration stemming from the $5.8-billion purchase of Safeway Canada in 2013.

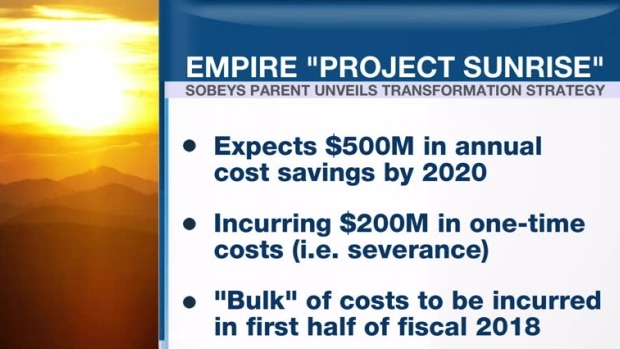

A key part of Medline’s turnaround strategy is an aggressive campaign to drive down costs. His so-called Project Sunrise aims for $500 million in annual savings by 2020.

“We still need to improve our margins as we lower our cost of goods sold and our [selling, general and administrative expenses] is too high,” he said on the conference call. “We're getting at this through Project Sunrise and we're making progress but we still have miles to go.”

Meanwhile, the company is seeing signs of improvement in Western Canada where it’s been fighting to restore customer confidence after the problem-plagued Safeway purchase.

“It’s night and day from what I saw last year,” Medline said about his store visits. “But it's a lot easier to turn off customers than it is to win them back. Many customers lost trust in our brand. And now, we have to earn that back.

Like its rivals, Empire is also flagging fallout from rising minimum wage rates. The grocer noted on Thursday it's expecting a $25-million hit this fiscal year, and another $70-million impact in fiscal 2019, as a result of wage hikes in Ontario and Alberta.

"The company has developed plans to mitigate the immediate impact of the proposed minimum wage increases in fiscal 2018 that are above and beyond the anticipated Project Sunrise savings and continues to develop further plans to mitigate the proposed minimum wage increase in fiscal 2019," Empire said in its earnings release.

In addition to legislative changes, the entire industry is also facing a new deep-pocketed threat after Amazon (AMZN.O) bought high-end grocer Whole Foods (WFM.O). As far as Medline is concerned, it’s a matter of been there, done that.

“I faced them before in hard goods and soft goods … and their strategy is so clear. So, I'm a little taken aback at the sudden concern in grocery from Amazon coming in,” he said on the call.

“I think our strategy is pointing us in the right direction to be able to face all of our competition, but we take it seriously.”