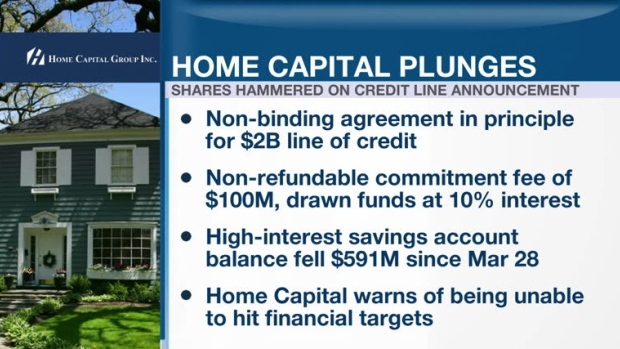

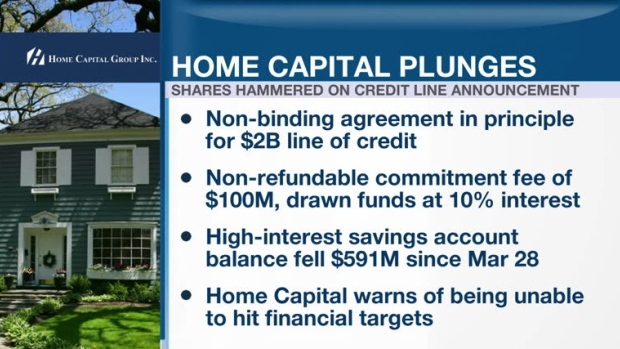

The chief executive officer of Veritas Investment Research thinks a regulator may have forced Home Capital Group to shore up its finances. In an interview on BNN, Anthony Scilipoti said the company may have been prodded into securing a non-binding agreement for a $2-billion line of credit due to its regulated nature.

“My reaction is that someone forced their hand here, and it’s likely the regulator,” he said. “I suspect that the decline in the high-interest savings account of $600 million that’s occurred essentially in the last month got the regulator somewhat panicked and said, ‘You need to shore up your capital here.’ Hence what looks really like a pound of flesh, or two pounds of flesh at least, it’s having to [give] to get access to this line.”

Scilipoti said he suspects that outside pressure came from the Office of the Superintendent of Financial Institutions. The regulator told BNN via email it is monitoring the situation closely, but has a longstanding policy to not comment on specific institutions it supervises.

“The capital and liquidity is what OSFI’s concerned about,” Scilipoti said. “The bigger [capital] issue becomes the GIC balance, the $13 billion. Those are holding well. The question is, in order for them to continue operating and doing new mortgages, they have to replenish those GICs.”

Scilipoti said diminished confidence in the lender’s stability remains a key risk for Home Capital, as retail investors may be concerned they’ll lose their capital if they put it in the company’s GICs.

“In order for them to gather assets … the depositors have to have confidence in them having the money available to them a year from now. It’s not just the one per cent [interest rate], it’s the money after that,” he said. “I believe when the OSC information came out, when the information related to the potential downgrade from S&P, I think that [had] people’s backs against the wall.”