Aug 23, 2017

Feds' tax plan could affect 'millions': Deputy Conservative leader Raitt

BNN Bloomberg

The federal government is facing a growing backlash against efforts to close tax loopholes it says give wealthy individuals an unfair advantage.

Deputy Conservative Party Leader Lisa Raitt called the government’s proposals “a sneaky summer tax” that she says could impact “millions” of small business owners, farmers, doctors or other entrepreneurs. That is significantly higher than the estimate given by the Ministry of Finance in July that the changes would impact an estimated 50,000 Canadian families.

“I think millions either will be directly affected in how they have structured their financial plan or they are going to be affected because they have been hired by a family business,” she told BNN in an interview on Wednesday.

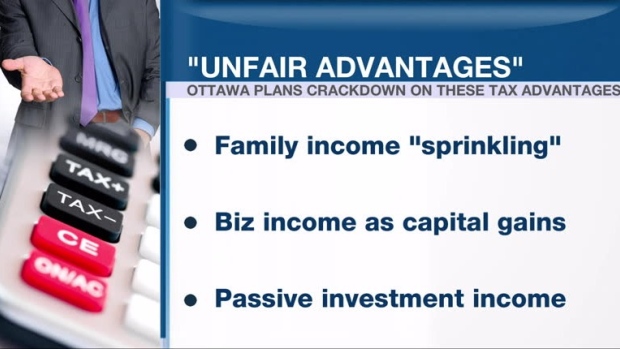

Finance Minister Bill Morneau outlined the proposed changes last month. They include cracking down on what Ottawa considers to be unfair advantages that allow some Canadian families to reduce their tax bills.

The first of these practices is so-called income sprinkling, which allows the owner of a private corporation to divide their income between themselves and their spouses and/or children to lessen the income tax burden.

Ottawa is also targeting passive income investing — the practice of placing money into a corporation without using it to grow their business. In addition, the government is targeting alleged misuses of exemptions to capital gains tax rules.

Raitt says the federal government’s 75-day write-in consultation period – which began on July 18 – doesn’t allow those affected enough time to understand what the tax changes could mean for them in the long run.

“There [are] a lot of Canadians that are saying, ‘This is going to have a huge effect on our economy and our ability to create jobs. So, don’t you think we should know what the effect is before we put [the new rules] into place?’” she said.

But a high profile member of Morneau’s economic advisory panel is defending the proposed tax code changes. Ken Courtis, chairman at Starfort Investment Holdings, says the changes will have a positive effect on the tax bills of Canada’s middle class.

“We’ve had an explosion in the number of people who have incorporated themselves as businesses and they have taken themselves out of the top tax rate and put themselves into a very low tax rate,” Courtis told BNN in an interview . “That has put more of a burden on people who can’t reorganize themselves - people who are working on an assembly line at General Motors, or as a bank teller - they are now paying higher tax rates sometimes [than] doctors or lawyers and that’s not fair.”

With files from BNN Reporter Jameson Berkow and Producer John Gray