Mar 10, 2017

TD shares see biggest one-day decline since 2009 on sales target report

, Reuters

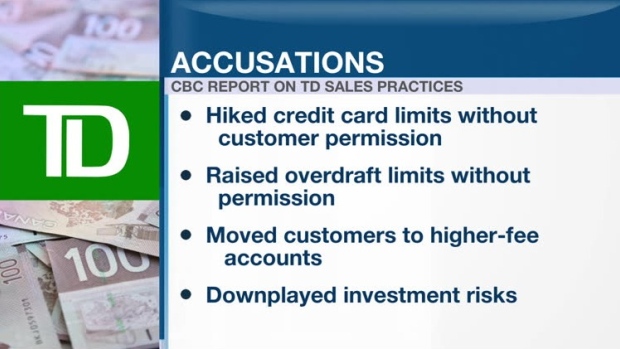

Shares in Toronto-Dominion Bank (TD.TO) on Friday had their biggest one day decline since December 2009 after CBC News reported that employees of the bank were being pressured to meet high sales revenue goals, traders said.

In an emailed response to Reuters regarding the CBC story, Toronto-Dominion Bank said, "The environment described in the media report is very much at odds with how we run our business, and we don't recognize it from our own perspective, experience or assessments."

Shares in TD closed down 5.55 per cent to $66.00. The loss is the bank's worst single-day percentage loss since Apr. 20, 2009 when shares dipped 5.4 per cent.

“The environment described in the media report is very much at odds with how we run our business, and we don't recognize it from our own perspective, experience or assessments,” wrote TD spokesperson Alison Ford in an email to BNN. “To uphold our commitment to doing the right thing, we have procedures in place designed to monitor sales practices and to detect any issues if they do arise. While we are confident our organization does not encourage or permit the type of behaviour [described in the CBC report], if we became aware of such instances occurring, it would be unacceptable to us.”

Ford declined to comment on whether any TD employees have been fired as a result of the allegations.

The Office of the Superintendent of Financial Institutions told BNN in an emailed statement that it is "aware of the issue" but does not publicly comment on supervisory work.

"We expect boards and senior management of federally regulated financial institutions to be proactive, and to apply best practices related to corporate governance applicable to their institution," an OSFI spokesperson told BNN via email.

"The senior management and board of directors of a financial institution are ultimately responsible for ensuring compliance with the applicable legislation and guidance, and for the day-to-day operations of the bank."

- with files from BNN