Nov 11, 2016

Teck Resources could be debt-free in just 6 quarters, CEO says

, BNN Bloomberg

Teck Resources (TCKb.TO) could be debt-free in 18 months, if the copper, coal and zinc price rally continues, Don Lindsay, president and CEO of Teck Resources, told BNN in an interview on Thursday.

So far this year, shares of the copper, coal and zinc producer have soared nearly five-fold to currently trade above $30 per share, making the company one of the best-performing stocks on the Toronto Stock Exchange. The company now has a market value of about US$16.2 billion.

With strong copper, zinc and coal prices, Lindsay says the company could generate US$1 billion in cash in the fourth quarter.

Lindsay’s first priority is debt reduction during this free cash flow period. “At these current spot prices, we could be debt-free in six quarters,” he said.

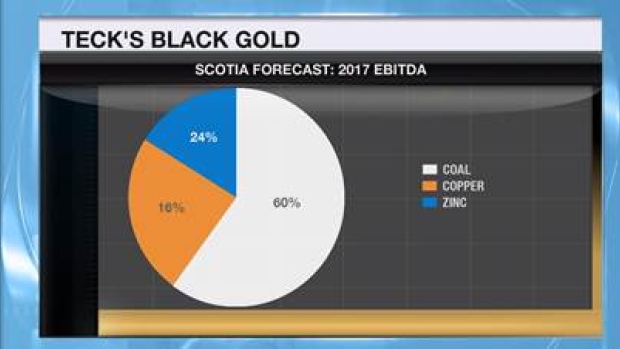

The rally has been driven largely by the rally in coal prices. The steelmaking coal price benchmark has surged from US$92.50 in Q3, to US$200 in Q4. The current spot price is US$310. Scotia Capital estimates coal could make up about 60-percent of Teck’s profits by next year.

Teck is also poised to profit from a looming shortage in the global zinc market, Lindsay said. Zinc smelters are charging Teck US$75 a tonne, down from the US$300 it usually costs to process the metal, he said.

“That tells you they’re desperate,” Lindsay told BNN. “They’re going to run out of concentrate and won’t be able to produce the metal and then zinc will be short.”

Copper prices are also strong, but Lindsay remains cautious on the outlook for the red metal over the next couple of years.

The recent U.S. election victory of Donald Trump may also be good news for the company. Trump has promised to increase spending on U.S. infrastructure projects, which could create more demand for base metals, he said.