Apr 19, 2017

The FOMO market: Money manager says fear is propping up stocks

Fear and greed are keeping the equity markets afloat, not underlying strength in the economy or a particularly bullish outlook for earnings, according to Vestcap Investment Management Managing Director Lyle Stein.

“We have FOMO in the housing market, there’s also FOMO – fear of missing out – in the equity market,” he told BNN in an interview Wednesday. “People who might get nervous don’t sell because they might miss out.”

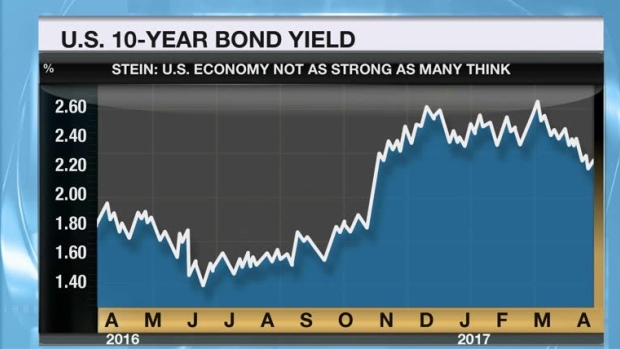

Stein’s biggest concern is the decline in the U.S. 10-year bond yield.

The yield has slipped below 2.30 per cent, which Stein views as a sign the American economy is not as strong as many people believe. “We need to see higher interest rates to reflect the U.S economy is growing,” he said. “Higher interest rates typically equate with higher growth.”

U.S. earnings season continues to ramp up and while there’ve been plenty of earnings beats, Stein suggests investors focus on the top line. “That’s where it gets a bit dicey,” he said, highlighting disappointing revenue from Johnson & Johnson and IBM.

Following a “really good year in 2016,” Stein said, “how to keep clients from losing money is more important [in the current environment] that catching the next trade to make money.”