May 2, 2017

The Valeant turnaround plan: CEO Papa on name change, Pearson, asset sales

BNN Bloomberg

As shareholders vented frustration with embattled drugmaker Valeant Pharmaceuticals (VRX.TO) at the company’s annual shareholder meeting in Laval, Que. the company’s CEO reiterated his belief that he’ll be able to turn the ship around.

Speaking with BNN’s Amber Kanwar, Valeant CEO Joseph Papa shared his thoughts on everything from a new name to an old Chief executive.

Here’s a roundup of Papa’s thoughts on some of the hot-button topics facing Valeant:

PAPA ON A POTENTIAL NAME CHANGE

"Yes, we are going to consider all the alternatives for our name, but the reality is – to me – this is really all about a turnaround and really generating the performance that our shareholders deserve for the future, which comes back to launching new products, and investing in research and development and making a difference in patients’ lives."

"As with any relationship it comes down to how we work with our individual customers… Do we have to consider all alternatives, including a name change? The answer is yes, we have to. It would not be good governance if we didn’t consider it."

"Having said that, I’m not here today to tell you that we’re going to make a change, I’m simply saying that from a governance point of view we’re looking at all the alternatives to improve the business – starting with the performance side, starting with reducing debt but ultimately also looking at any of the reputational issues the company faces."

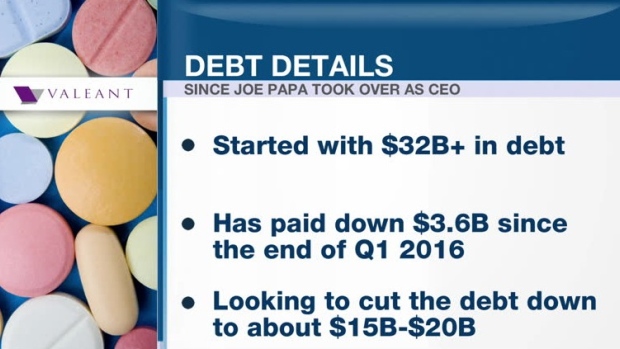

ON THE COMPANY’S DEBT

"We’ve made great progress in the past 12 months. We’ve paid down $3.6 billion of debt just in the last 12 months from the first quarter of 2016. We think that’s an important progress step."

"It’s not that we’re trying to get our debt to zero. Any company with our type of strong cash flow can sustain debt. I believe the right number for us to sustain is somewhere in that $15-20 billion range, given that we’re going to continue to, obviously, grow our EBITDA in the future."

ON A REPAYMENT SCHEDULE

"We have some existing asset sales already underway… Accumulatively we’ve done 10 different asset sales. Those sales have generated approximately $2.3 billion up-front with additional milestones, we think they’ll generate approximately $2.7 billion. Add to that the additional asset sales that we currently have underway, I feel comfortable in saying that we’ll reduce our total debt by $5 billion by the date we talked about, which is Feb. 2018."

ON FORMER CEO MICHAEL PEARSON

"The company entered into an agreement with my predecessor. We believe we fulfilled the requirements of that agreement relative to consulting. He has not been a consultant for us in quite some time, so we believe we have met that requirement."

"Obviously, he has a different view, but we’ll continue to work that through."

ON WHETHER TO SELL THE CROWN JEWELS

"What we’ve done is identified what is core to us. The core to us is our dermatology franchise, our Bausch & Lomb franchise and also what we do in the [gastrointestinal] business. Those are the core businesses that we’re going to continue to invest in for the future."

"We believe the asset sales that we will do will be other businesses that I would refer to as ‘non-core’ that will allow us to reduce the debt while still also improving operational performance."

ON PRICING

"In 2016 we made a very purposeful decision not to increase the pricing for any of our dermatology products or any of our ophthalmology products… Meanwhile we did pay incremental rebates to the managed care plans and other players along the way. That had a net effect of reducing prices in a very wide part of our portfolio."

"This year we did come back with what we think is reasonable pricing. We’ve agreed to keep our pricing [to] what I would refer to as ‘single-digit pricing,’ that’s in terms of the gross pricing, obviously, what we realize will be even lower than that."

"We’ve taken what we think is the responsible approach towards pricing since I joined, approximately a year ago. It was centred with a patient access and pricing committee to help guide us through that decision, which has multi-disciplined people from all across the Valeant organization."