Apr 22, 2020

Troubled oil ETF again shuffles holdings amid market mayhem

, Bloomberg News

Average oil price likely mid-US$30 per barrel for 2020: Energy analyst

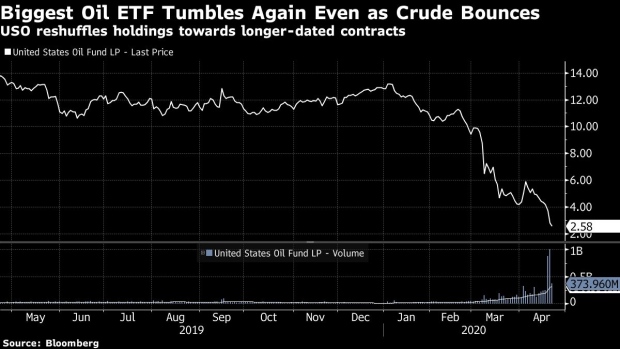

For a second straight day, the biggest oil exchange-traded fund reshuffled the mix of futures it owns to track crude prices, extending their average expiration amid unprecedented volatility in its markets.

The US$3-billion United States Oil Fund LP (USO) took the measure in an effort to reduce its holdings in near-term contracts that have borne the brunt of losses as the global coronavirus lockdown saps demand for oil amid a supply glut.

The fund, which is the biggest single owner of West Texas crude futures, moved more of its money into contracts expiring in August and September while reducing June and July.

Moving money to longer-dated contracts means the fund is incurring roll costs, but is protecting against the possibility of having its net asset value fall below zero in the event that front-month oil futures turn deeply negative again.

“What they’ve just said is, ‘we’re going to try to use every item we can think of right now to try and solve this problem we have with the contango in our primary strategy.’ Will any of those things work? No one can know,” said Ken Monahan, senior analyst at Greenwich Associates covering market structure and technology.

On April 16, the fund announced it was moving 20 per cent of its exposure to the second-month futures contract. USO on Tuesday shifted to holding 40 per cent in June futures, 55 per cent in July, and 5 per cent in August.

According to the most recent filing , the fund holds roughly 20 per cent of its portfolio in the June contract, 50 per cent in the July contract, 20 per cent in the August contract, and 10 per cent in September.

Extending the expiration of the contracts has become an urgent matter for the ETF after May futures, which the fund had already rolled out of, became engulfed in a selling frenzy on Monday that turned their price negative.

Losses have tended to mass in near-term contracts over the past few weeks as concern mushroomed about where to store the crude delivered in such contracts.

At the same time, frantic reshuffling of its holdings has wrecked any claim the ETF has to being a passive product. In its filings, U.S. Oil Fund repeatedly notes that the strategy untethers it from its stated investment objective.

“In an attempt to save the fund and boost its price, they have destroyed the utility of the product,” said Peter Cecchini, Cantor Fitzgerald’s chief market strategist.

USO fell 8.7 per cent to US$2.57 as of 2:48 p.m. in New York. The ETF is mired in a nine-day losing streak that has wiped about 40 per cent from its price. Despite its 80 per cent plunge this year, the fund has drawn massive inflows from retail investors confident they can find a bottom in oil prices.

In addition to reshuffling its holdings in futures, the fund yesterday suspended new share issuance after reaching limits from previous filings.