Jul 4, 2016

U.K. aims to outdo Canada by slashing corporate taxes

If Britain’s finance minister has his way, the United Kingdom’s corporate tax rate will fall below Canada’s.

George Osborne, who as Chancellor of the Exchequer in the U.K. holds a position similar to Canada’s Minister of Finance, disclosed plans over the weekend to lower the British corporate tax rate from roughly 20 per cent today to a figure “less than” 15 per cent. The British Treasury Department confirmed the plan Monday in response to questions from BNN, but was unable to specify how far below the 15 per cent threshold – which would be roughly in line with Canada’s federal corporate tax rate – the new British rate may fall.

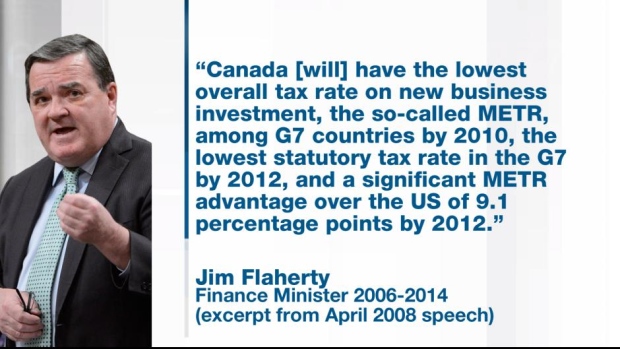

In the months leading up to the Great Recession in 2007 and 2008, Canada’s then-finance minister Jim Flaherty embarked on a comprehensive plan to make Canada’s corporate taxation policy more competitive when stacked up against other jurisdictions. The core of the strategy focused on the 15 per cent federal taxation, which Flaherty argued would help Canada win investment away from other countries.

“Canada [will] have the lowest overall tax rate on new business investment, the so-called METR [marginal effective tax rate], among G7 countries by 2010,” Flaherty said in an April 2008 speech before heading to Washington, D.C. for a G7 Finance Ministers meeting, “[We will also have] the lowest statutory tax rate in the G7 by 2012, and a significant METR advantage over the US of 9.1 percentage points by 2012.”

During a speech in New York City three years later, Flaherty continued to boast of his cuts to federal corporate taxes as the most successful weapon in the war to maximize economic growth.

“These tax reductions have allowed Canada to achieve an overall tax rate on new business investment that is substantially lower than you’ll find in any other G7 country,” Flaherty told the Canadian Association of New York in June of 2011. “We have established a business tax advantage for Canada.”

Creating a similar advantage for the U.K. could prove more difficult, largely because Canada is a net exporter of goods and services whereas Britain is a net importer of nearly everything, except for financial services. The Organization for Economic Cooperation and Development (OECD) warned in an internal memo seen by Reuters shortly after the Brexit vote that Britain risked creating a “tax haven” type of economy if it gets too aggressive with corporate tax cuts.

The OECD memo argued the country was simply too big for the benefits of such a strategy enjoyed by other countries such as Ireland – with its 12.5 per cent corporate tax rate – to offset the potential for significant losses to overall government revenue.

Days after Flaherty resigned for health reasons in March 2014, noted tax law expert Tim Wach wrote an op-ed describing his tax changes as having “made Canada competitive,” citing a major study that found Canada was the only G7 country to win a top-10 ranking among 189 countries rated according to ease of corporate tax compliance.

“On the corporate tax system,” Wach wrotein The Globe and Mail, “Mr. Flaherty can be proud of his legacy.”

Britain’s Osborne is clearly hoping to create a similar legacy, but it remains to be seen whether it will prove one in which he too can be proud.