Jan 27, 2017

35 states lean on Canada for trade; but we’re a small piece of their economic pie

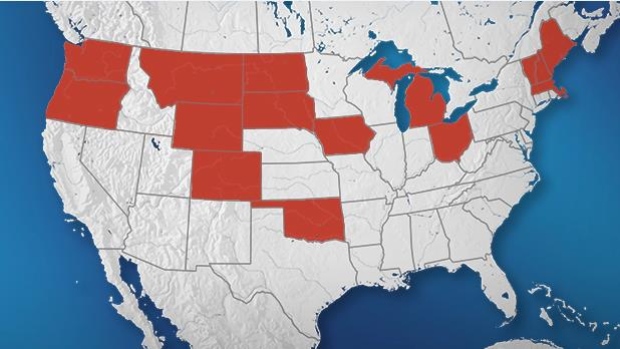

Canadian officials have underscored the tight trade relationship with the United States in the wake of President Donald Trump’s inauguration, pointing to the fact 35 states count Canada as their largest export customer to hammer home the economic imperative for free trade. Prime Minister Justin Trudeau highlighted the figure at an event in Saskatoon on January 25, telling the crowd those links render it “almost impossible to imagine any increasing of barriers.”

But in reality, exports account for a small slice of the economic output of many of those states, leaving few with much skin in the game if Trump takes draconian trade measures. Research by University of Calgary Economist Trevor Tombe shows Canada has a lot more to lose in any protracted trade spat, as only a trio of states relied on trade with Canada for nine per cent or more per cent of output as of 2015, including a pair of relative economic minnows, Vermont and Montana. Here’s a breakdown of cross-border trade with the states that depend most on Canada.

Vermont, which holds the title as the smallest state economy at an annual GDP of US$30 billion, primarily imports hydro-electric power from Quebec as part of a 26-year agreement that took effect in 2012. On the flip side, its main export to Canada is computer chips and related circuitry, produced at the state’s largest private employer, IBM, in its Essex Junction facility.

Montana is the third-smallest economy in the United States and is primarily reliant on the exchange of commodities with Alberta and, to a lesser degree, Saskatchewan. Crude oil accounted for nearly 65 per cent of imports in 2015, down from 75 per cent just two years prior. Copper, coal and cigarettes take the top three spots for exports from the state.

No state has as much at stake as Michigan, as the cross-border nature of the auto industry ties 15 per cent of its fortunes to the Great White North. 22 of the top 25 exports in 2015 were tied to car manufacturing, and the largest imports are car parts produced in Ontario, reflective of the fact an individual component may cross the border as many as eight time before final assembly.

WIDESPREAD IMPACT

While the economic pain of any potential tariffs will be felt most acutely in those three states, the impact could potentially spread further. 35 of 50 states count Canada as their largest export market, ranging from as low as a 12 per cent share in Massachusetts to as high as 71 per cent in North Dakota.

On the flip side, Canada’s customers south of the border thin out significantly, with only 15 states counting us as the main source of goods and services.