Feb 17, 2017

‘A painful quarter and year’: Watsa closes shorts after Trump bump hammers Fairfax

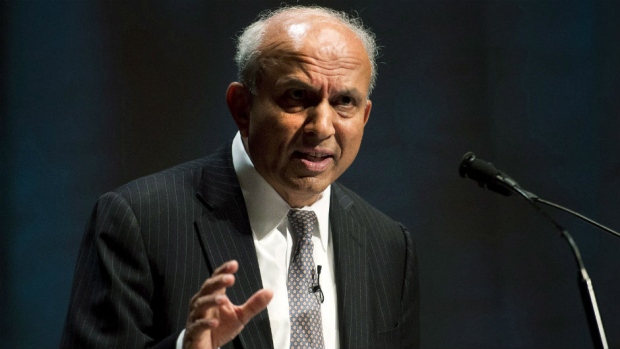

Prem Watsa, generally recognized as Canada’s most famous investor, is dropping his bearish stance on the markets.

The CEO of Fairfax Financial has decided to yank his firm’s equity hedges after suffering a $1.07-billion net loss on its investments in the fourth quarter, and an even greater loss for all of 2016.

“[Full-year] net losses on investments of $1,204 million were primarily as a result of fundamental changes in the U.S. in the fourth quarter that may bolster economic growth and business development in the future. Consequently, we removed all our defensive equity index hedges and reduced the duration of our bond portfolios to approximately one year,” Watsa said in a press release late Thursday.

"It was a painful quarter and year for Fairfax," Watsa added during a conference call on Friday.

Watsa warned of further volatility in the year ahead during the conference call, telling investors 20-30 per cent fluctuations in stocks prices are “very much possible,” but highlighting opportunity in volatile markets, so long as investors are extremely selective stock pickers.

He also highlighted the increased prospect for U.S. growth under the new Donald Trump White House, calling for a revival of the “animal spirits” in the U.S. economy.

Fairfax’s decision to drop its defensive stance marks a swift reversal for Watsa. As recently as Nov. 3, when Fairfax announced its third-quarter earnings, Watsa declared his firm was sticking with its defensive strategy because he was “concerned about the financial markets and the economic outlook in this global deflationary environment.”

But now, Fairfax says recent changes in the U.S. have “obviated the need for defensive equity hedges” and as such has closed out all its short positions in the Russell 2000, S&P 500 and TSX 60.

“The thing about Fairfax and Prem Watsa is that you’ve almost got to regard him in a totally different kind of way,” said Michael Smedley, executive VP and chief investment officer at Morgan Meighen & Associates, in an interview with BNN. “He’s a kind of [Berkshire Hathaway CEO Warren] Buffett. So I don’t know that it matters too much. It sort of feels like it’s a little bit late to be doing that [closing shorts], but then how could he have known?”