Oct 26, 2017

Aecon CEO vows no job losses in $1.45B takeover by Chinese firm

BNN Bloomberg

Aecon Group (ARE.TO) has agreed to be taken out by China’s CCCC International Holding (CCCI) in a $1.45-billion all-cash deal, a takeover that won’t result in any job cuts, according to the Toronto-based company’s chief executive officer.

“We won’t have a single job loss,” Aecon President and CEO John Beck told BNN in an interview Thursday. “There will be job growth at Aecon.”

Under the terms of the deal, which puts one of Canada’s biggest engineering giants in foreign hands, Aecon shareholders will receive $20.37 per share — a 23-per-cent premium to Wednesday’s closing price.

Beck noted Aecon had conversations with Canadian companies, without naming that, but said CCCI put forth the best offer.

“We didn’t go to China, they came to us,” he said.

However, former Industry Minister Tony Clement told BNN on Thursday that the Liberal government should not rubber-stamp the sale.

"No country in the world – even in a western style democracy - would just let a takeover happen if it's contrary to the national interest or the security interest of the country," Clement told BNN in an interview. "Australia does the same thing, the U.K. does the same thing, the Americans do the same thing. So, I don’t think we should be bashful here in looking after our own interests."

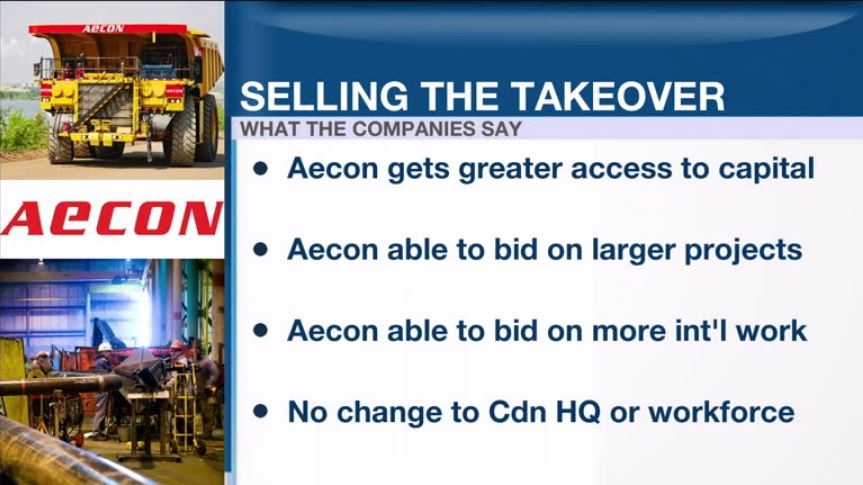

Earlier on Thursday, Aecon touted the benefits of scale it gains by being swallowed up by its China-based buyer.

“This transaction creates significant and immediate value for Aecon shareholders, strengthens our competitive position in Canada and abroad with enhanced capabilities and financial resources, and provides expanded opportunities for our people," Beck said in a press release.

“It’s just positive all the way around for Canada,” Beck told BNN. He added the deal would allow Aecon to do more business internationally.

Speaking with reporters at an event in Burlington, Ont., Prime Minister Justin Trudeau said Ottawa will be looking at the sale closely.

“Obviously this is an extremely important issue. Canada as a general rule is open to investment,” he said. “[The Aecon sale] will be examined very carefully by the Investment Canada Act to ensure that safety and security is not being compromised and ensure that it is in the net benefit of Canadians.”

The proposed acquisition will fall under regulatory scrutiny because its enterprise value exceeds the Investment Canada Act’s review threshold of $1 billion.

“Even though we have seen a hiatus from Chinese entities buying commodity assets in Canada, we do not envision any hurdles to the deal completion,” wrote National Bank Analyst Maxim Sytchev in a report to clients.

“This is an excellent outcome for Aecon shareholders because we don’t believe there is another entity now willing to pay this type of price,” he added.

CCCI, the overseas investment division of China Communications Construction Company Limited, said Aecon will continue to be headquartered in Canada, and it will not be rebranded.

Here's a look at some of Aecon's recent projects:

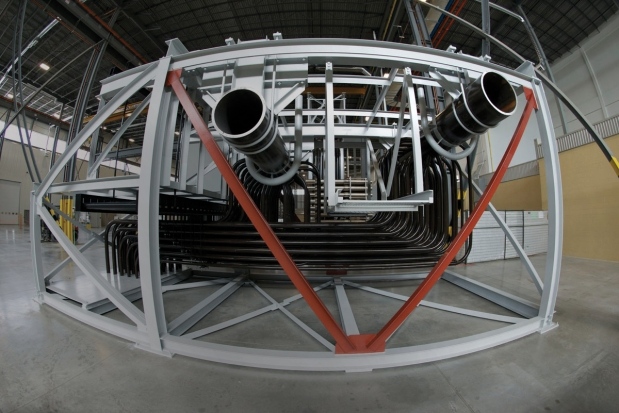

The John Hart Generating Station in Campbell River, B.C. Aecon’s JV is constructing the new water intake, tunnel and water bypass facility, and a new underground generating station. (Courtesy of aecon.com)

Aecon is an equal partner in the $5.3-billion Crosslinx consortium to develop the Eglinton Crosstown LRT project in Toronto. (Courtesy of aecon.com)

Aecon is converting the Regina lagoon treatment plant into a new sophisticated biological nutrient removal treatment facility. (Courtesy of aecon.com)

Aecon is involved in one of the first Light Rail Transit projects for the Waterloo Region in Ontario (Courtesy of aecon.com

The Darlington Nuclear Refurbishment project (Courtesy of aecon.com)