Feb 8, 2017

Apple undervalued? 'The possibilities are endless': Baskin Wealth CIO

, BNN Bloomberg

It’s not often that investors see a US$130-plus stock as being undervalued, but Baskin Wealth’s CIO says now is the time to get in on Apple (AAPL.O).

The iPhone maker reported quarterly earnings that topped estimates last week and reclaimed the title as the top smartphone seller in the world as sales of the iPhone 7 and 7 Plus surged.

Baskin Wealth Management Chief Investment Officer Barry Schwartz sees that user base as the key to growth for the Cupertino, California-based tech Goliath.

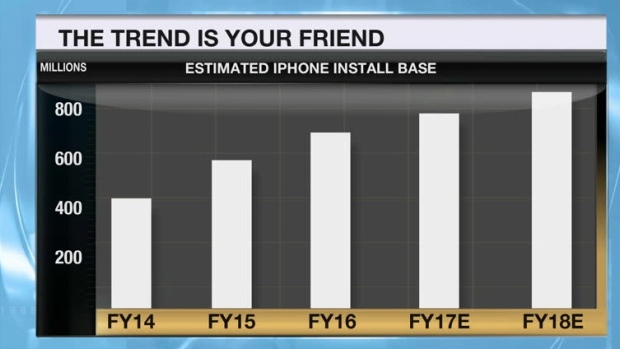

“I think by 2018 they’re going to have one billion iPhones installed,” Schwartz told BNN on Wednesday. “The install base is going to be one billion users. You think about the monetization of that. Everybody talks about Facebook and it has 1.8 billion users, but they don’t make as much money as Apple does.”

“I think the possibilities are endless, whether it’s payments, whether it’s video, you name it.”

While Schwartz says he usually advises waiting for stocks to dip, he told BNN he’s comfortable with the stock at its current level.

“Here is a time when I think I don’t have to wait for a dip, because I think the company is still so attractively valued here,” Schwartz said. “I look at all the other stocks that have run up and yet Apple offers the most compelling investment opportunity.”

Apple opened trading at US$131.33 on Wednesday.

One potential boost could be headed Apple’s way via U.S. President Donald Trump’s promise to reform corporate tax laws and repatriate capital. Apple CEO Tim Cook last week said he was “optimistic” the plans would go through.

Schwartz thinks there’s a lot Apple could do with the extra cash.

“If Apple is able to bring back – what do they have? - US$200 billion [in] cash back to the United States to use to either increase dividends or buy back stocks, that’s huge for the company,” Schwartz said.

“Meanwhile you have the stock price, the valuation, trading at pedestrian levels: I think 12 times earnings, not even including all the cash on the balance sheet. I don’t, for the life of me, understand why it’s not trading at a market multiple and, of course, we have this iPhone 8 coming out soon.”

Schwartz predicted Apple’s shares could trade as high as 17-to-18 times earnings, landing the stock in the US$170-180 range by 2018.

However, while there’s value to be had, he warns that investors may have to exercise patience for the company to reach the potential he sees.

“They’re spending a lot of money on R&D, billions and billions of dollars. I firmly believe there’s new products – both hardware and software - coming out that will boost the needle at Apple,” he said.

“At the end of the day, though, we are dealing with a lot of large numbers. This is a company that does US$220 billion in revenue. It’s not like they’re going to be able to do US$400 billion overnight.”