Apr 18, 2024

Asian Stocks Slump as Mideast Woes, Hawkish Fed Sour Sentiment

, Bloomberg News

(Bloomberg) -- Asian stocks slid as broad risk aversion swept through markets on renewed concerns over an escalation of tensions in the Middle East and worries about higher-for-longer US rates.

Friday’s session started on weak footing after hawkish commentary from Federal Reserve officials, indicating rate cuts could be pushed back toward the end of the year if they occur at all in 2024.

Losses deepened as Israel launched a retaliatory strike on Iran less than a week after Tehran’s rocket and drone barrage, according to two US officials, raising fears of a widening conflict across the Middle East. However, markets pared some of the risk-off moves after Iran downplayed the incident.

Read more: Israel Launches Retaliatory Strike on Iran, US Officials Say

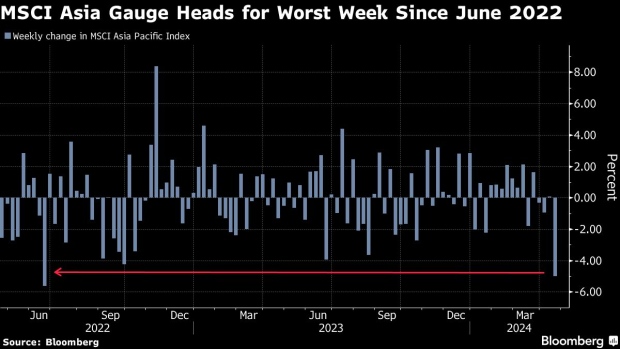

The MSCI Asia Pacific Index fell as much as 2.6% before paring its loss to less than 2%. Heavyweight Taiwan Semiconductor Manufacturing Co. was the biggest drag on the regional benchmark after scaling back its outlook for expansion, cautioning that the smartphone and personal-computing markets remain weak.

“Geopolitical jitters have gripped markets,” said Manish Bhargava, a fund manager at Straits Investment. “Investors are expected to exhibit greater risk aversion, resulting in heightened volatility in asset prices. The demand for safe-haven assets is likely to surge,” he said.

Taiwan’s equity benchmark closed 3.8% lower, while Japan’s Topix Index fell 1.9%, leading losses in key regional equity gauges. India’s Sensex overcame initial slump to rally 1% as voting in the nation’s weekslong election kicked off Friday.

Stocks across the Asia region have tumbled more than 4.5% this week, on course for their biggest weekly loss since June 2022, as worries about US monetary policy and geopolitical tensions plague risk sentiment globally.

“The market selloff is intensifying, we may trim a little further and increase cash allocations,” said Mohit Mirpuri, senior partner at SGMC Capital Pte. “We will only hold on to our core long-term holdings and would reduce the tactical plays.”

Sectors to Watch

- Asian shipping stocks climb on speculation that conflict in the Middle East will lead to higher freight rates and boost the companies’ profits.

- Hanwha Aerospace and other defense stocks in Asia buck global weakness to rally on bets that intensifying concerns about escalating conflict in the Middle East may lead to more demand for their arms and weapons.

- A gauge of Asia Pacific semiconductor stocks declines as much 6.7%, the most since March 2020, after TSMC scaled back its outlook for a chip market expansion and Middle East tensions triggered a broader selloff across the region.

- Shares of Macau casino operators fell in Hong Kong, with Sands China leading the declines after its parent, Las Vegas Sands, said remodeling at an entertainment center and a hotel in Macau will hurt results this year.

- The shares of Asian miners including Genesis Minerals jump after the metal surged past $2,400 an ounce as concerns over rising tensions between Israel and Iran stoke haven demand.

- Asian semiconductor sector stocks decline after TSMC scaled back its outlook for a chip market expansion, cautioning that the smartphone and personal-computing markets remain weak. TSMC slides as much as 6.6% in Taipei, the most since October 2022.

- TSMC shares fall as much as 6.1% in Taipei, the most since October 2022, after the company reported first-quarter results. While analysts are broadly positive on the company, especially given an expected growth tailwind from AI, they see signs of weakness in key product categories like smartphones and PCs.

Markets at a Glance

- MSCI Asia Pacific Index fell 1.7%

- Japan’s Topix Index fell 1.9%; Japan’s Nikkei Index fell 2.7%

- China’s CSI 300 Index fell 0.8%; Hong Kong’s Hang Seng Index fell 1%; Hong Kong’s Hang Seng China Enterprises Index fell 1%

- Taiwan’s Taiex Index fell 3.8%

- South Korea’s Kospi Index fell 1.6%; South Korea’s Kospi 200 Index fell 1.8%

- Australia’s S&P/ASX 200 Index fell 1%; New Zealand’s S&P/NZX 50 Gross Index fell 0.3%

- India’s NSE Nifty 50 Index rose 0.7%

- Singapore’s Straits Times Index fell 0.3%; Malaysia’s KLCI Index rose 0.2%; Philippines’s PSEi Index fell 1.2%; Indonesia’s JCI Index fell 1.1%; Thailand’s SET Index fell 2.2%; Vietnam’s VN Index fell 1.5%

- 10-year Treasury yield fell 5.1 basis points

- Cboe Volatility Index rose 1.75 points

- Bloomberg Dollar Index was little changed

- West Texas Intermediate crude rose 0.7% to $83 a barrel

- Euro rose 0.2%

Here Are the Most Notable Movers

- Taiwan’s tech-heavy stock benchmark closed 3.8% lower on Friday to mark its biggest one-day fall since October 2022 as TSMC dragged down the market with its weaker outlook statement.

- Schneider Electric Infrastructure’s shares tumbled as much as 5%, taking their two-day loss to the most since mid-March, after Goldman Sachs initiated coverage with a sell recommendation on Thursday.

- Infosys shares fall nearly 2.9% on Friday, touching the lowest in five months, after the IT services company forecast tepid sales growth for the year.

- HDFC Life Insurance’s shares fall as much as 4.1%, the most since Jan. 23, after analysts reduce their price targets for the stock amid growing concerns that competition will hurt margins.

- TSMC shares fall in Taipei after the company reported first-quarter results. Li Auto shares also decline after the EV maker launched its new L6 model.

- Bangkok Bank shares drop as much as 3.1% after it reported first-quarter net income that came in below the average analyst estimate. The miss was partly due to a decline in net interest margin and an increase in non-performing loans.

- Jiangxi Copper shares rise after the price target is raised by Citi on expectations that copper prices will rise.

- Shares of cloud-based commerce firm Weimob fall as much as 17% to record low, after the company said in a filing it will place 277m new shares at HK$1.13 each.

- Li Auto shares fall as much as 7.2% in Hong Kong, the most in a month, after the EV maker launched its new L6 model. Morgan Stanley said pricing is slightly higher than some investors’ expectation, but remained largely positive on the outlook.

- Taiwan Semiconductor Manufacturing Co. scaled back its outlook for a chip market expansion, cautioning that the smartphone and personal-computing markets remain weak.

Related Market News

- Taking Stock: China’s economic growth is boosting the stocks of Japanese manufacturers with ties to the country.

- Inside Asia: Most Asian currencies weaken as concerns about tensions in the Middle East damp demand for risk assets. The Malaysian ringgit is supported by a rise in oil prices.

- Global Wrap: An escalation of tensions in the Middle East kept stock markets on edge, though haven assets including bonds and the dollar gave up some early gains after Iranian media appeared to downplay the impact of Israeli strikes.

Notes From the Sell-Side

- The current swings in the foreign-exchange market are a “long way” from a sustained shift in the balance of trade, and therefore unlikely to trigger a G-7 or G-20 statement or agreement, says John Greenwood, an economist and a key architect behind the Hong Kong dollar peg.

- Investors are pulling money out of equities as a strong US economy and sticky inflation fuel concerns that the Federal Reserve will keep interest rates higher for longer, according to Bank of America Corp. strategists.

- US stock funds suffered the largest two-week outflow since December 2022 at $21.1 billion, according to a note from Bank of America.

- Treasury curve steepener trade has gotten a lot “more interesting” again after the recent repricing in Fed rate-cut bets, according to Nan Fung Trinity HK Ltd.

- Front-end of the Treasury curve could see a move up to 5.25% if investors “price out” the odd of any Federal Reserve rate cut for the year, according to Jack McIntyre, portfolio manager at Brandywine Global Investment Management.

- The risk aversion affecting markets may represent a buying opportunity given many companies are not fundamentally impacted in a Middle East regional conflict, said Vey-Sern Ling, managing director at Union Bancaire Privee.

- The South Korean won looks set to drop through the key level of 1,400 per dollar, pressurized by geopolitical risks, an expected delay in Federal Reserve rate cuts and weak Asian peers like the yuan and yen, according to Shinhan Bank.

This story was produced with the assistance of Bloomberg Automation.

--With assistance from John Cheng, Ishika Mookerjee, Abhishek Vishnoi and Ashutosh Joshi.

(Updates prices.)

©2024 Bloomberg L.P.