Apr 17, 2024

Banxico’s Espinosa Says It’s Too Soon for a Long Easing Cycle

, Bloomberg News

(Bloomberg) -- Mexico central bank Deputy Governor Irene Espinosa on Wednesday said it’s too soon to talk about a prolonged easing cycle, less than a month since the central bank cut interest rates for the first time since 2021 and with markets waiting for clues on the next step.

Banxico, as the central bank is known, is facing some “credibility issues” regarding the difference between its year-end inflation projection of 3.6% and the market’s estimate of 4.1%, she said. Espinosa spoke in an interview with Bloomberg News after an event of the Institute of International Finance, in the sidelines of the IMF spring meetings in Washington.

“It is not a problem of credibility with respect to the mandate or the institution,” she said, but related to the “expectation that the market has with respect to what we project.”

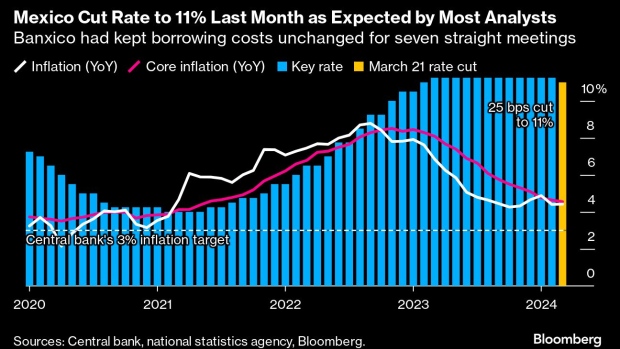

On March 21, Banxico cut it key interest rate by a quarter point to 11%, finally joining the regional trend for monetary easing, with Espinosa being the only policymaker voting to keep the rate unchanged at 11.25%.

Read More: Mexico Cuts Key Interest Rate For First Time Since 2021

But the bank, especially Governor Victoria Rodriguez Ceja, has reiterated that future adjustments to borrowing costs will be gradual and evaluated one at a time, depending on available information, so the possibility of a rate pause is on the table for the next meeting on May 9.

Espinosa said Banxico keeps a close eye on US Federal Reserve moves, but isn’t attached to them. She also said she won’t ask for reappointment to her position, and that the decision corresponds to that of the president.

In the minutes of the last meeting, policymakers raised concerns about a resilient domestic economy and inflation, especially in the services sector. Given those risks, members called for small adjustments, cautioning against rapid reductions going forward.

Espinosa said in the minutes that monetary policy faced additional challenges, including pressures from wage increases and expansionary fiscal policy.

The Pemex Issue

During the IIF event, Espinosa said there’s an urgency regarding the fiscal sustainability of Mexican state-owned oil company Petroleos Mexicanos.

She said Pemex, as the company is known, has received a lot of government support without any change in its governance or business model.

“It is a huge concern that can affect fiscal sustainability, that can affect sovereign ratings, and that would affect in general the costs of financing and the whole Mexican economy,” she said.

Given that reality, then, she said the Pemex issue is one of the priorities to be solved by the next administration.

“The amount of resources that Pemex received in the last two years are humongous. So, if we think about next year going back to fiscal consolidation and Pemex not having changed its business model, then the need will not only continue but it will increase,” Espinosa said.

Banxico targets inflation at 3%, plus or minus one percentage point. Consumer prices increased 4.42% in March from a year before, below the median estimate of 4.5% from analysts surveyed by Bloomberg. Monthly inflation hit 0.29%, also under the median estimate of 0.36%. Core inflation, which strips out volatile items like food and fuel, slowed to 4.55% compared to a year prior, below economists’ forecast of 4.63%.

Banxico Deputy Governor Jonathan Heath said earlier that inflation hasn’t slowed as the bank would like to see due to the federal government expansionary fiscal policy and a tight labor market.

During a Banorte podcast, Heath said it’s important to be very cautious and have a lot of patience to not prematurely start a definitive cycle of the normalization of the monetary policy rate.

Read More: Mexico’s Central Bank Strikes Wary Tone on Any Future Rate Cuts

--With assistance from Todd Gillespie.

©2024 Bloomberg L.P.