Apr 19, 2024

Bitcoin Risks Another ‘Sell-the-News’ Market Move After Halving

, Bloomberg News

(Bloomberg) -- Bitcoin’s propensity to rally ahead of much-touted industry milestones is raising the risk that the software modification known as the halving slated for later Friday may turn into another “sell-the-news” event.

“Everything that is known is already discounted into the price,” Joel Kruger, market strategist at LMAX Group, said in a statement. “With that said, anyone who would have wanted to be buying Bitcoin because of the halving event has already done so, which suggests in the short-term aftermath of the halving, we could see a ‘sell-the-news’ type of reaction.”

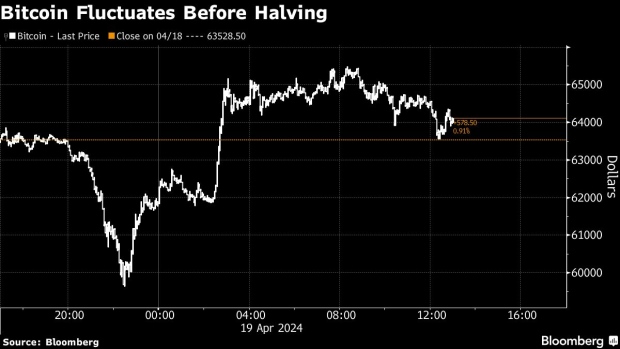

It’s not rare for Bitcoin to experience volatile price swings around impactful events, and these fluctuations continue to highlight the boom or bust nature of Bitcoin. After an intense bull-run ahead of the US Securities and Exchange Commission’s approval of Bitcoin exchange traded funds in January, the digital currency tumbled in the days that followed the sign-off. The digital asset tumbled in the wake of reaching an all-time-high in early March.

Bitcoin was little changed on Friday at around $64,200 after earlier sinking more than 6% as a bout of acute geopolitical tension roiled markets worldwide. In the past week or so, the tit-for-tat Middle East conflict has overshadowed the halving, which will curb new supply of the token.

Halvings historically bolstered the price of the largest digital asset. This time around, Bitcoin hit a record in March before the event and analysts in JPMorgan Chase & Co and Deutsche Bank AG say the halving is most likely already priced into Bitcoin.

Rather than on the token’s price, the main implication would be on Bitcoin mining, JPMorgan analysts wrote in a note Thursday. As unprofitable miners exit the Bitcoin network, they expect the sector to consolidate, with publicly-traded firms the best positioned to gain market share.

If any volatile price swings in Bitcoin happen because of the halving, it could be because of the “sell-the-news” cycle, said Crypto.Com Chief Executive Officer Kris Marszalek.

“As we approach this date there may be some selling coming up” due to buy-the-rumor, sell-the-news trading, Marszalek said during a Bloomberg Television interview on Tuesday. Over a longer period, the halving will make a “substantial difference” and is a “positive development for the market,” he said.

©2024 Bloomberg L.P.