Mar 29, 2017

BNN's Daily Chase: Sterling takes a pounding as U.K. triggers Article 50

By Noah Zivitz

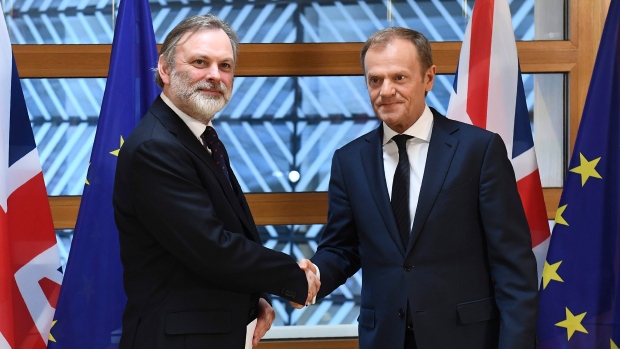

Today is the day the world has been waiting for since June 24. British Ambassador to the EU Tim Barrow delivered a letter to European Council President Donald Tusk at 7:20 a.m. ET, officially triggering Article 50 and a two-year window of negotiations to formalize the United Kingdom’s split from the European Union. "Today we do give effect to the democratic decision of the people of the United Kingdom who voted for us to leave the European Union," Prime Minister Theresa May told the U.K. parliament.

Despite the fact this day has been more than nine months in the making, we’re seeing the British Pound drop against almost all major counterparts today. “…There's no logic in that,” Societe Generale’s Kit Juckes wrote about today’s currency move in his note to clients. “Today's ceremony changes nothing. A divided Great Britain decided to leap lemming-like into the sea months ago, led by a Prime Minister who promises a bright future but has no clear road-map showing us how to get there.”

As context, the Pound has plunged more than 16 per cent against the U.S. dollar since June 24 and roughly 12.5 per cent against the Canadian dollar over the same time period.

Today we have an opportunity to weigh the risk of unintended consequences and the implications for Canada’s economy and Canadian businesses that operate in Europe.

MORNEAU ADVISOR WARNS ON DOLLAR, HOUSING, AND MORE

Catherine Murray went around the world with ex-Goldman Sachs Asia Vice-Chair Ken Courtis (who’s also a member of Bill Morneau’s Advisory Council on Economic Growth) yesterday afternoon. Some highlights from the conversation: He said Canada can’t afford to sit on its hands amid policy uncertainty in the U.S., adding, “We can’t make any mistakes.” He then mapped out why it’s “not going to be an easy transition” for Canadian housing, and said he sees the loonie sagging “into the mid 60s and below” against the U.S. dollar over the next 18 months.

CANADIAN FULL COURT PRESS CONTINUES IN D.C.

Natural Resources Minister Jim Carr and Infrastructure Minister Amarjeet Sohi are tag-teaming the Canadian messaging in D.C. today as Justin Trudeau’s government continues its campaign to underscore the mutual benefit of Canada-U.S. ties - and aims to avert any collateral damage from President Donald Trump’s policies. We’re expecting to speak with Carr this afternoon. It will be interesting to get his perspective on yesterday’s executive order rolling back environmental rules.

OTHER NOTABLE STORIES

- The lede in one of The Wall Street Journal’s A1 stories tells us all we need to know about disruption in the asset management industry: “BlackRock has started a shake-up of its stock picking business, relying more on robots rather than humans to make decisions on what to buy and sell.” It’s a great conversation starter today.

- Samsung is expected to unveil its newest smartphone, the S8, at a launch event today in New York. Big question is how/if it can repair goodwill with customers who were burned (literally and figuratively) by the Galaxy Note 7s.

- The B.C. NDP says it would implement a retroactive tax on foreign homebuyers if it wins the provincial election.

RELEASES/EVENTS:

- Notable earnings: Lululemon (4:30 p.m. ET conference call).

- 7 a.m. ET: U.K. PM Theresa May speech to parliament.

- 11 a.m. ET: Samsung holds launch event for S8 Galaxy smartphone.

- 11:30 a.m. ET: Boston Fed President Eric Rosengren delivers speech in Boston.

- 11:45 a.m. ET: Justin Trudeau media availability in Winnipeg.

- 1 p.m. ET: Restaurant Brands International presentation at CIBC conference.

- 1:30 p.m. ET: Finance Minister Bill Morneau holds Facebook Live event at Western University in London, Ontario, plus media availability.

- National Bank Financial holds two-day financial services conference.

- Natural Resources Minister Jim Carr starts three-day official visit to D.C.

- Infrastructure Minister Amarjeet Sohi starts three-day visit to D.C.

- U.K. government to trigger Article 50, starting official Brexit negotiations.

Every morning Commodities host Andrew Bell writes a ‘chase note’ to BNN's editorial staff listing the stories and events that will be in the spotlight that day. Today's note was written by BNN's Managing Editor Noah Zivitz. Have it delivered to your inbox before the trading day begins by heading to www.bnn.ca/subscribe.