Sep 1, 2017

Canada’s 'emerging markets'-style growth boosts bet Poloz could raise rates Wednesday

By Noah Zivitz

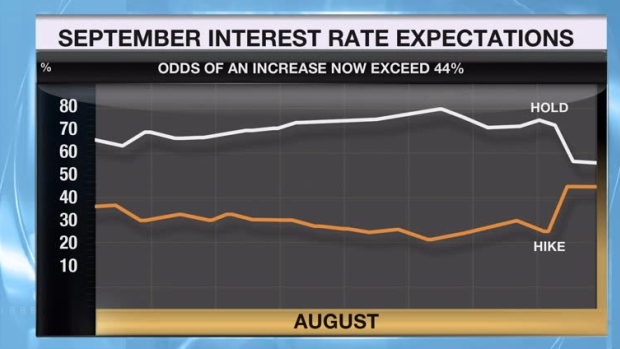

It's still not the majority view, but expectations the Bank of Canada could raise its trendsetting interest rate as early as Wednesday are on the rise.

After data last week showed Canada's economy sailed past expectations in the second quarter as growth surged 4.5 per cent, the implied probability of the central bank boosting its target for the overnight rate to 1.0 per cent on Wednesday was hovering around 55 per cent as of Friday afternoon.

CIBC Capital Markets joined the September camp on the heels of the latest GDP report, while indicating it would likely be a "dovish hike" -- which would be a signal to the market that the bank will pause after undoing the second of two rate cuts introduced as insurance after the crash in crude prices.

But not everyone is convinced the central bank will telegraph a hike-and-hold strategy.

Scotiabank joined the September-rate-hike crowd late Thursday, with an expectation the bank has even more in store.

"We expect a neutral-hawkish bias in a nod to how there are further hikes to come beyond simply unwinding the two 25-basis point cuts in 2015," Scotia Head of Capital Markets Economics Derek Holt wrote in a report to clients.

Holt acknowledged the perception that the bank might be leery about raising rates now, lest it help turbocharge an already-surging loonie -- but noted the central bank looks at the loonie’s performance against a broad basket of currencies.

And while Scotia noted a rate bump next week is "not a slam dunk", it reckons Canada could get too much of a good thing if the economy keeps rolling along at what Holt called an "emerging-markets style of growth."

"The whole point," he wrote, "is that Canada needs the slower growth that would arise from tightening policy levers."